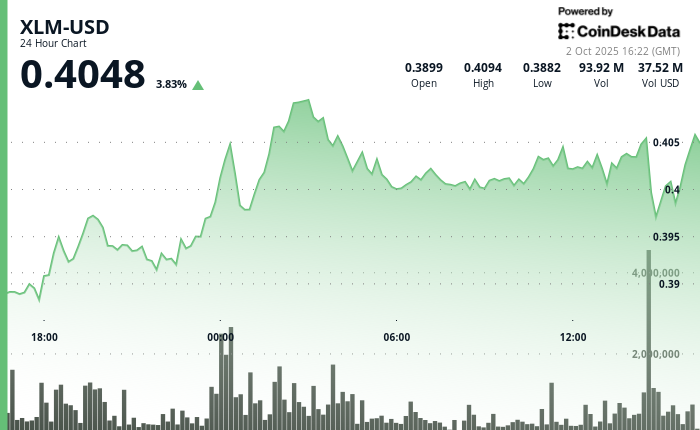

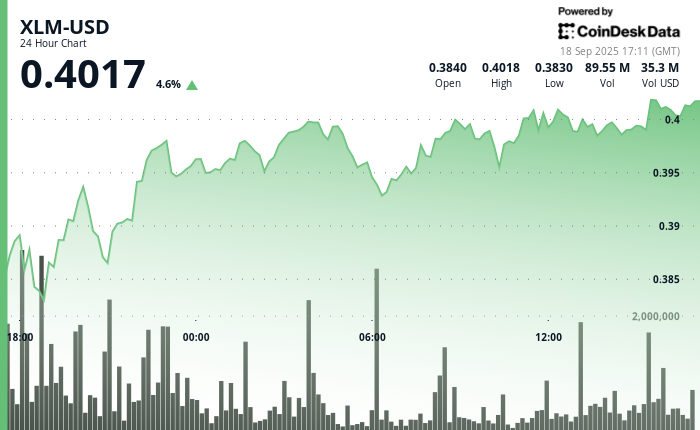

Stellar’s XLM rose 4% in the past 24 hours, climbing from $0.39 to $0.40 with a brief push above $0.41. Trading volumes surged to more than double the daily average, establishing support at $0.40 and resistance near $0.41, signaling potential consolidation before the next move.

The rally followed Bitcoin.com Wallet’s integration of Stellar, giving millions of users access to its low-cost, fast payment network and DeFi tools. The news coincided with heightened volatility as XLM repeatedly tested the $0.41 level while holding key support.

Institutional demand is also fueling momentum, with traditional finance showing growing interest in blockchain-based payments. Strong volume during the breakout highlights rising market engagement as XLM pushes through psychological resistance zones.

Short-term action reinforced this trend: between 13:11 and 14:10 UTC on October 2, XLM briefly spiked to $0.41 on trading volumes nearly double the hourly average, underscoring robust bullish sentiment despite near-term resistance.

XLM/USD (TradingView)

Technical Metrics Indicate Persistent Strength

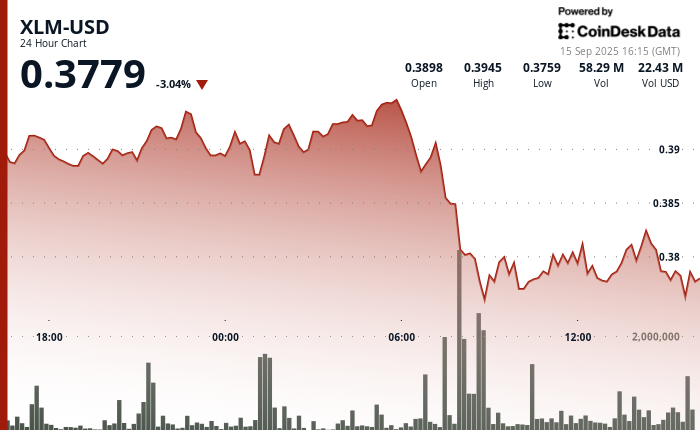

- Rally developed through two separate phases featuring initial advancement to $0.40 followed by decisive breakout exceeding $0.41 during overnight sessions.

- Outstanding trading volumes of 90.15 million and 61.23 million documented, substantially above 24-hour benchmark of 36.85 million.

- Essential support formed at $0.40 with substantial volume backing while resistance materialized around $0.41.

- Volume surges surpassed 1.4 million during 13:45 and 13:51 periods, exceeding hourly benchmark of 750,000.

- Repeated resistance challenges near $0.41 with support stabilization around $0.40 threshold.

- Robust upward trajectory preserved with balanced profit-taking patterns above essential $0.40 psychological barrier.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.