Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Stay Ahead with Our Timely Insights of Today’s Next Crypto to Explode

Check out our Live Next Crypto to Explode Updates for September 1, 2025!

Crypto is so unthinkably huge at the moment, a nearly $4 trillion industry that’s aiming for world domination.

Recent headlines talk of Circle and Mastercard planning to add USDC to global payment systems, Ethereum and Bitcoin treasuries in the billions of dollars, and Google building its own blockchain.

Bitcoin has an all-time growth of over 180,000,000%, Dogecoin over 39,000%, and some of the newest presale coins often pump 10x, 100x, or even 1,000x on rare occasions.

Explosive potential is probably the single best description for what we’re seeing today in crypto.

Quick Picks for Coins with Explosive Potential

If you’re looking for the most recent insights on the next crypto to explode, stay tuned. We update this page frequently throughout the day, as we get the latest and greatest insider insights for chart sniffers and traders looking for the next coin to explode.

Disclaimer: Crypto is a high-risk investment, and you may lose your capital. Our content is informational only, and it does not constitute financial advice. We may earn affiliate commissions at no extra cost to you.

Next Crypto to Explode After Whales Snap Up 340M $XRP in Two Weeks

September 1, 2025 • 11:00 UTC

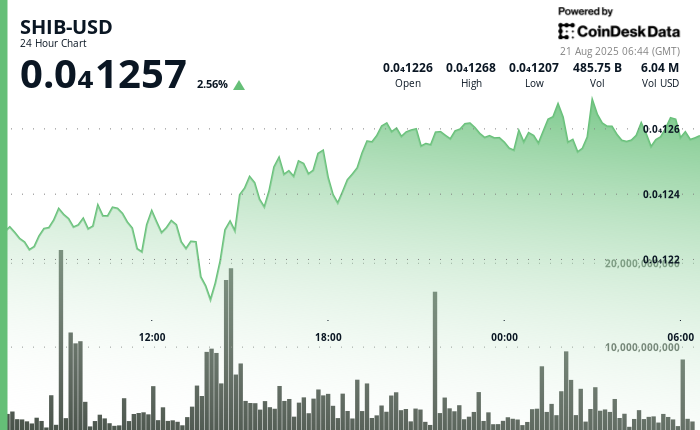

$XRP might be in a slump at the moment, but that hasn’t stopped whales from buying up the coin in the second half of August.

Crypto analyst Ali Charts confirmed this via a post on his X page.

This could signal that large investors remain bullish on $XRP or many are buying the dip, as it is currently trading $2.81, down by 4.32% in the last seven days, according to CoinMarketCap data.

The cryptocurrency has also seen a massive trading volume of $5.78B in the past 24 hours, translating to a 75.53% jump.

Continued bullishness on cryptocurrencies could be a boon for Best Wallet Token ($BEST), which is raising funds to support its crypto wallet of the same name.

It has raised over $15.3M, making it one of the most likely to be the next crypto to explode.

Learn more in our ‘What is Best Wallet Token’ page.

Digital Wallets Account for 16% of Online Payments – This Wallet Currency Could Be the Next Crypto to Explode

September 1, 2025 • 10:00 UTC

The US is warming up to digital wallets, a new market study by PYMNTS shows. And it’s not Gen Z leading the charge.

Here’s what the PYMNTS report revealed:

- For online payments, credit cards and digital wallets are the most popular.

- 16% of survey respondents said they used digital wallets for recent purchases.

- Digital wallets have seen the highest adoption rate among Millennials and Gen Xers.

- Security and ease were the most commonly cited reasons for using credit cards online.

Older consumers are also warming up to digital wallets, the data suggests.

We also know that crypto adoption is on the rise, having nearly tripled since 2021. Today, approximately 28% of American adults own digital assets.

As the growing adoption of digital wallets, crypto, and self-custody solutions converge, Best Wallet Token ($BEST) could be the next crypto to explode in the upcoming years.

Its digital crypto wallet bridges the gap between retail and crypto in several ways — easy onramping, stablecoin support across multiple chains, and an upcoming debit card with a cashback program.

Visit $BEST’s 15.3M+ presale for more details.

New Pump.fun Token Hits $1.8M in 24H Volume. Proof That Any Meme Coin Has the Potential to Explode?

September 1, 2025 • 10:00 UTC

A new mystery token broke the meme coin market.

Put out via Pump.fun’s launchpad, the unnamed, ticketless coin reportedly reached $1.8M in trading volume within its first 24 hours. Pump.fun later took to X, posting a cryptic message that further fueled hype and speculation. However, there have been no new developments since.

But it wouldn’t be the first time when crypto traders have pumped the most bizarre projects. Look no further than $FARTCOIN – a token that serves no purpose, yet somehow maintains a $737M+ market cap and $110M+ daily trading volume.

Some coins aren’t even trading, but are already making waves among degens.

Maxi Doge ($MAXI), for example, is nearing $2M+ raised during presale just weeks after the ICO launched. Unlike the hundreds of new coins popping up recently, though, this one benefits from viral meme branding.

A gym-bro Giga Doge obsessed with leverage maxxing and chasing the pump? Investors are saying ‘yes,’ and our $MAXI price prediction sees the potential for a 9x pump this year.

See the meme on Maxi Doge’s website.

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.