Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

The most recent Ethereum price predictions hint at a rich end of the month for Ethereum with a potential October bull ready to attack.

This optimistic outlook comes as Ethereum just recorded the lowest 7-day average of the year at 0.93 as $ETH has been on a downward spiral since the 19th.

Cryptoquant believes that there’s a simple explanation for the discrepancy: the current bearish consensus is likely to attract long investors.

An extreme bear market always creates investment opportunities, especially in the institutional sphere, giving off a powerful buy signal. Before that happens, though, we may see an even more abrupt correction if $ETH fails to consolidate above $4,000.

Either way, Pepenode ($PEPENODE) stands to gain massively in the coming months, as investors already see it as the next 1000x crypto currently in the presale oven.

Will Ethereum Recover in October?

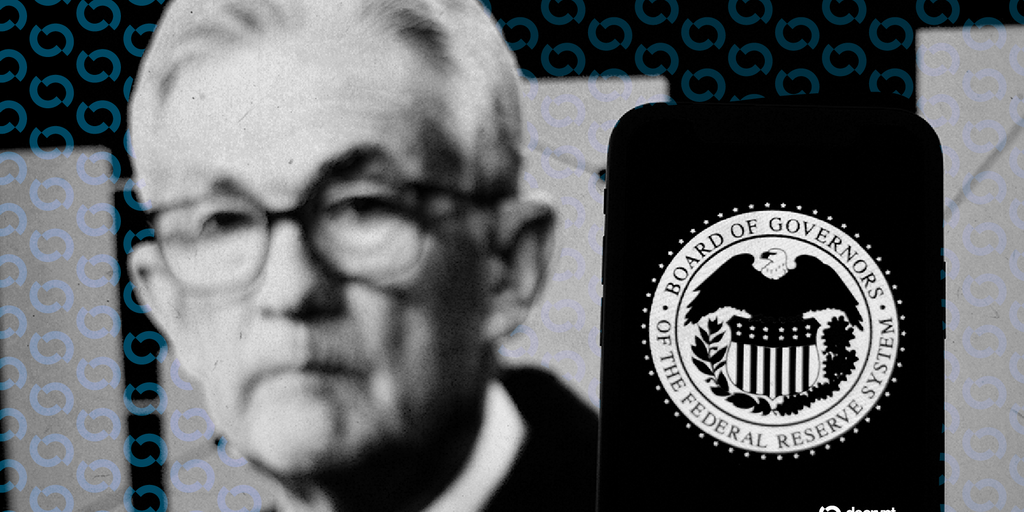

It’s very likely that Ethereum will begin to recover as October sets in as the next FOMC meeting draws close.

The last meeting took place on September 16-17, which saw Bitcoin add almost $3K to its price, stopping just shy of $118K. Then came the 19th and the entire market entered a brutal correction phase with red across the board.

$SOL, $ADA, $DOGE, $XRP, and $ETH are the biggest losers in the top 10, which brings us to the main point of this article: it’s not Ethereum, it’s the market. The bearish wave is a symptom of stronger shorts, as investors capitalize on the recent pump following September’s FOMC meeting.

We expect the market to change direction in October, especially since FedWatch puts the odds of another tax rate cut at almost 92%.

Simply put, this means that the next bull phase, expected near mid-October, will likely push Bitcoin to a new ATH, which means $ETH could also see a breakout above $5,000.

Analyst Lark Davis is smashingly optimistic, reminding us that Ethereum’s charts look ‘eerily similar to September 2020’, when the market embarked on a ‘multi-month bull run’.

This means that $ETH’s recent contraction is temporary, and we may see a rally in early October, so long as the coin holds above $4K. If not, we could see a crash to $3.5K, which would push the bull pump to late October.

Pepenode’s $1.3M presale stands to gain either way, as it’s already on the road to becoming the next big hit of 2025.

How Pepenode Brings Coin Mining Into the Presale Sphere

Pepenode ($PEPENODE) addresses the main problem associated with modern presales: the lack of incentives for early participation. You can draw in investors with a meaty staking reward, rich post-launch promises, and a fat ROI if the token goes ballistic.

But that’s not enough. You need a system to keep investors engaged beyond the simple buy-and-forget tactic, which is how most presales operate, and Pepenode has the solution: active mining gameplay.

Pepenode allows you to buy your own mining nodes, upgrade them, and create your personal virtual mining facility, which allows you to mine tokens.

The leaderboard keeps track of the top miners and rewards them with higher staking rewards and bonuses based on their progress. Post-launch, you’ll also receive rewards in actual meme coins like $DOGE, $PEPE, and $FARTCOIN.

Pepenode allows you to learn and practice your coin mining without dealing with expensive rigs, spicy electricity bills, and melted GPUs. Professional crypto miners are also expensive and often difficult to set up, making them unfit for casual miners.

With Pepenode, you can experience coin mining with the help of a personalized setup, which you can upgrade at your own pace.

Our price prediction for $PEPENODE is $0.0023 by the end of the year and $0.0244 by 2030. Based on the token’s current presale price of $0.0010702, we’re looking at a 5-year ROI of 2,179%. If the token sees mainstream adoption, it could climb even higher.

And let’s not forget about the staking APY, currently at 969%, further incentivizing early participation.

You can read about how to buy $PEPENODE right here and visit the presale page to grab your tokens today.

This isn’t financial advice. Do your own research (DYOR) and manage risks wisely before investing.

Authored by Bogdan Patru, Bitcoinist: https://bitcoinist.com/ethereum-prediction-traders-watch-pepenode-as-next-1000x-crypto/

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.