In brief

- Bitcoin dropped while gold jumped to two-month highs as tensions between Israel and Iran marred global stability.

- Over $1 billion in crypto positions were liquidated within 24 hours of Israel’s airstrike.

- Divergence strengthens Bitcoin’s correlation with risk assets in times of crisis, analysts say.

Late Thursday evening, Israeli fighter jets struck Iranian nuclear facilities, opening a wave of instability across global markets, with two camps split on what to do: those running for shelter and those fleeing risk.

Gold, long considered a safe haven, beckoned investors seeking safety from the escalating Middle East conflict. Bitcoin, often touted as digital gold, instead joined the exodus of risk assets.

“The traditional buyers of gold are not in the crypto market yet,” Stephen Wundke, director of strategy and revenue at quantitative digital asset investment firm Algoz, told Decrypt. He added that gold buyers are “risk-off investors who will return to the safe haven that is gold, as they see it, whenever there is potential conflict.”

Though gold is up over 2% on the day, Wundke thinks this is “hardly a rush to cover,” adding that Bitcoin, for one, had been falling “well before there was any news of the strike on Iran.”

Data from CoinGecko show that the price of Bitcoin plunged 3.6% to $103,900 Friday morning as initial reports that Israel launched airstrikes on Iranian nuclear facilities came in.

At the same time, gold leapt to $3,427.90 per ounce, showing how the two assets diverge during a geopolitical crisis. It is up 7% in the past month and more than 46% year-to-date, data from Trading Economics indicate.

“Bitcoin is sometimes seen as a safe haven, but in reality, it often moves in line with tech stocks rather than gold,” Jay Jo, senior research analyst at Tiger Research, told Decrypt. “Because of this coupling, Bitcoin and gold can show opposite price trends during geopolitical crises.”

Risk reality check

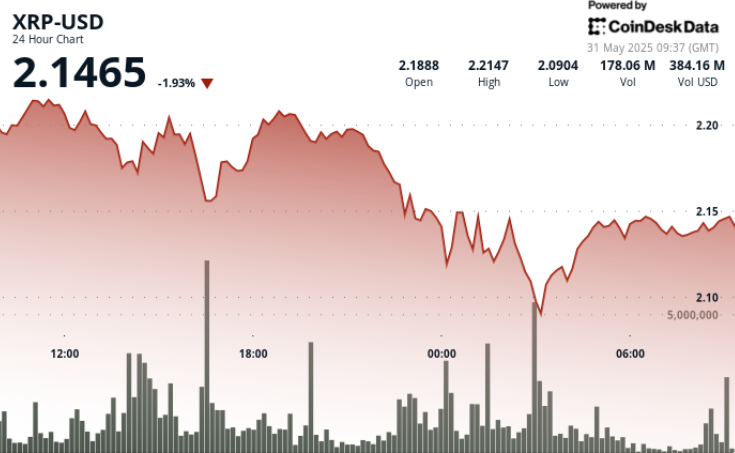

While the smoke hasn’t settled, altcoins including Ethereum, XRP, and Solana tapped over $1 billion in liquidations, most of which are in long positions. Meanwhile, traditional safe havens, including gold, the U.S. dollar, and government bonds, attracted flight-to-safety flows as investors dumped risk assets.

“Fundamentals are more at play with BTC than problems in the Middle East, at the moment,” Wundke noted, adding that June is “traditionally a quiet month for BTC” and that the market appears to be “in a consolidation phase.”

Still, Wundke argued that if “any significant escalation in the Middle East” occurs, it might affect Bitcoin and send it breaking below $100,000.

Sentiment has slipped over the past day; although the Crypto Fear and Greed Index currently sits at 61, indicating greed, it’s down 10 points on the day—and over 81% of predictors on Myriad expect it to hold below 64 through the end of the week.

(Disclaimer: decentralized on-chain prediction market Myriad was launched by Decrypt’s parent company, DASTAN)

Bitcoin’s younger, more leverage-prone investor base might have contributed to the selloff intensity, with some noting that a shift is underway.

“The bull case becomes [that] over time, young people care about it more than old people,” Galaxy Digital CEO Mike Novogratz claimed in a CNBC interview Friday. Gold “slowly gets replaced by Bitcoin” as the alpha crypto has increasingly become an institutionalized “macro asset,” he added.

Citing weighted demand from financial institutions such as BlackRock, Novogratz said that interest in Bitcoin as a macro-asset could be likened to “a ball rolling downhill.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.