Since the release of the celebrated and critically acclaimed RPG Clair Obscur: Expedition 33, key members of the development team at Sandfall Interactive have been on something of a global victory tour. The game is indebted to the Final Fantasy series and FromSoftware’s Souls games among others, and now the team have finally met their heroes.

“We met so many inspiring and great people,” director Guillaume Broche tells me, “so many legends of the industry and the games we play and adore. It was always very chill, actually. It was really just about sharing philosophies on how to make games and the games industry in general.”

Broche wasn’t nervous about meeting his heroes. “They’re actually very cool,” he says. “All the big directors we met, and even the smaller ones that we really love, we all speak the same language [of games].”

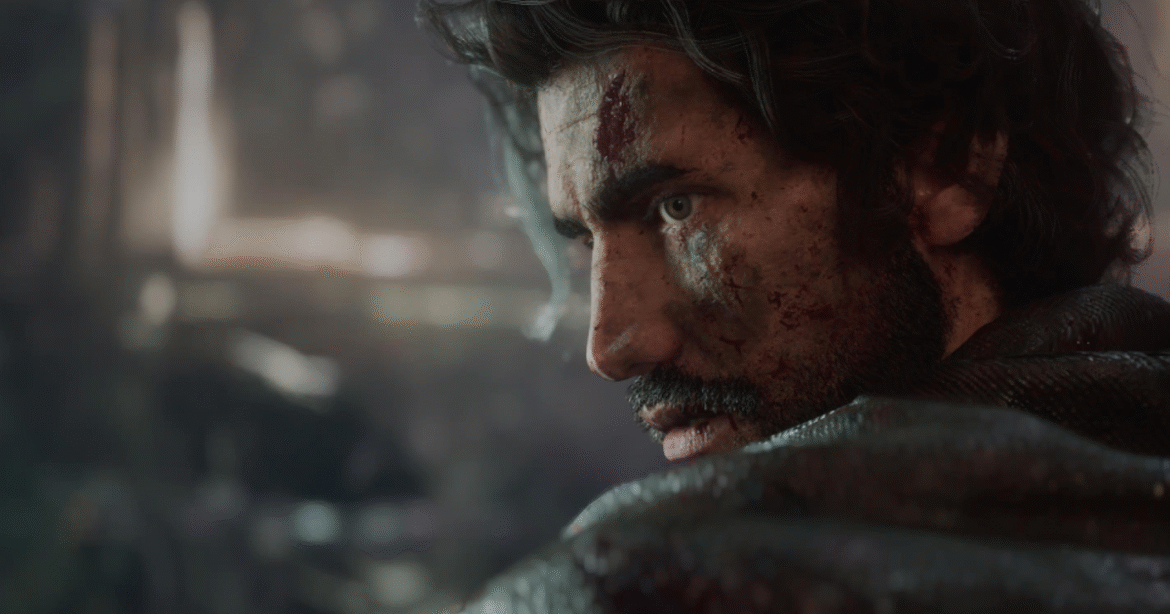

Clair Obscur: Expedition 33 | Launch TrailerWatch on YouTube

Indeed, where players have made countless comparisons between Expedition 33 and the iconic long-running franchises it’s inspired by, the developers themselves are supportive of one another. “It’s cool to see that among directors and people who make games, even on a technical level, on the producing level, really it’s about sharing and making the best games possible, and there is no real sense of competition,” says Broche. “It’s more how we can elevate each other to do our job better. And that’s a really great feeling I want to convey, because from the exterior it looks like everybody’s at each other’s throat, but really that’s not the case at all.”

One competition that remains this year, however, is Game of the Year, and so far Expedition 33 is seemingly one of the frontrunners. Broche describes the positive reaction to the game as “surreal”, as he didn’t expect it to be quite so far-reaching.

“I was saying before the game launched, we are going to find our niche and the players who love the game will really, really fucking love the game, but we are still expecting it to be a very small percentage of gamers,” he says, alluding to the expected popularity of turn-based games ahead of the game’s release.

“It exploded far beyond that. We are incredibly moved and grateful at how big it got and how it emotionally resonated with people.”

“I think the first shock was when we discovered the meta score,” adds Tom Guillermin, CTO and lead programmer. “There are so many great games that we look up to that are in that range of score. So when we discovered that, everybody was screaming with joy in the studio. It was such an emotional moment.”

Image credit: Sandfall / Eurogamer

The huge success of the game is a remarkable achievement for a debut game from a small studio. But that success, Broche and Guillermin assure me, isn’t going to change the studio – its size, the way it operates, or its future projects.

After Expedition 33 was released, there arose plenty of debate about the size of the team at Sandfall (while the core development team was around 30 people, there was additional outside help in animation, QA testing and more). So should the studio be considered indie, AA, or does it even matter?

“We don’t really care, to be honest. We are very much independent on everything we do,” admits Broche, noting publisher Keplar provided assistance. “I’d say probably the most accurate would be triple-I, because we are not really small, but we are also on the very lower end of AA production budgets and team size. We are not bothered that much by any classification, it doesn’t really matter.”

Broche describes Sandfall Interactive as a “small art house, where we make games that we love and want to play”. And that will continue, even despite its success, as it allows the team to take risks, be agile, and innovate.

“We know how to make a game with a team our size, a game we love, so that’s something we want to do again,” he says. “We don’t plan to grow the company that much…even for the next game. We don’t necessarily want to make something bigger. We want to make something as good, if not better, and that’s all that matters. The size is not really important, I think.”

Perhaps this is a lesson the industry could learn this year. Amid exploding budgets, creative ruts, and the desire for ever-growing profits, here is a studio working within its limits to deliver a passion project that players have responded to in their millions.

Image credit: Sandfall / Eurogamer

As such, I asked Broche about the scope of the project and how the design team decided what should be included. Being a small team, he says, meant they could adapt quickly, but initially Expedition 33 was Broche’s project and was intended to be created by an extremely small team which naturally led to a clear focus.

What’s more, the JRPG style of the game lent itself to a manageable scope. Turn-based combat, for instance, is “easier to do, in a way, than pure action games”, says Broche. “I would say it’s also a lot of happy accidents, because the kind of game I really love, they tend to take a lot of shortcuts – like JRPGs – and so the general game also matches very well with the size of the team. We would have struggled a lot more, of course, if we’d done a big open world with thousands of quests.” The use of a world map, too, allowed for agile development as it’s easy to slot in new areas.

“I think the most important thing is to define what your game is at the beginning and have a very strong vision at the very beginning so you know exactly what you want and what you don’t,” concludes Broche.

Guillermin adds there were very few features developed that didn’t make it to the final game, owing to that clarity of vision. Then, as the team grew, designers “had a lot of freedom to create a lot of content from the building blocks that we were providing them”.

“I think the most important thing is to define what your game is at the beginning and have a very strong vision.”

This is why, then, the game offers a turn-based combat system with such depth, while exploration is more linear, without offering the complex dungeons and puzzles of other games in the genre.

“It’s funny, we tried at some points to add puzzles and everything and it just didn’t fit at all with the game,” says Broche. “It felt completely off and broke the rhythm that we want for the game and made it less tight. I think it would have been great for the length of the game, because people would have been stuck for hours. But overall, we wanted something that is shorter than traditional RPGs and more packed in terms of rhythm and cutscenes and story and the battles.”

Image credit: Sandfall / Eurogamer

So what’s next for the studio? Broche has previously hinted Expedition 33 is “not the end” of the Clair Obscur franchise, but “clair obscur” as a term is rooted in art. Is that a theme we’ll see continue in future games?

“For me, Clair Obscur is more about a mark of greatness in terms of art and how we see games at Sandfall,” says Broche. “I used the term ‘art house’ before, and it’s really something I am very attached to. It’s games that, in one way or another, will feel very artistic in terms of music, visual, art, story – ideally, everything at once.

“That’s why we also chose an art theme that is very strong with the name Clair Obscur. It reflects that, and it also reflects contrast, which is something I personally adore in stories, where you will never have complete darkness or complete light, but what’s important is what’s in between.

“It also reflects the philosophy of the studio itself,” he adds. “We do some games that are very serious and sombre with some very light moments, of course, but overall, we don’t take ourselves very seriously. And the mood overall at the studio is very light, and we like to laugh all day long. So it’s really this contrast that is both in our game and in the studio, which feels very fitting for how we work on the story of the studio, and there is a spirit of the franchise, let’s say.”

Before that, Sandfall Interactive will release an update to Expedition 33 by way of a “thank you” to the fans. While the studio is tight-lipped about its content, it’s previously hinted it’s exploring new localisation and accessibility options among other additions.

What’s more, Broche tells me the update will have “a bit of whee and a bit of whoo”. No doubt fans will take the hint.