Hedera price drifted upward on Wednesday, Oct. 1, as the crypto market rebounded and as traders waited for the upcoming crypto ETF season.

Summary

- Hedera price has moved to the second phase of the Elliot Wave pattern.

- It also formed a double-bottom pattern on the daily chart.

- The coin will likely bounce back ahead of the spot HBAR ETF approval.

Hedera (HBAR) token rose slightly to $0.2200 from the September low of $0.2050. It remains 27% below the highest level this year.

Hedera price technical analysis signals to a rebound

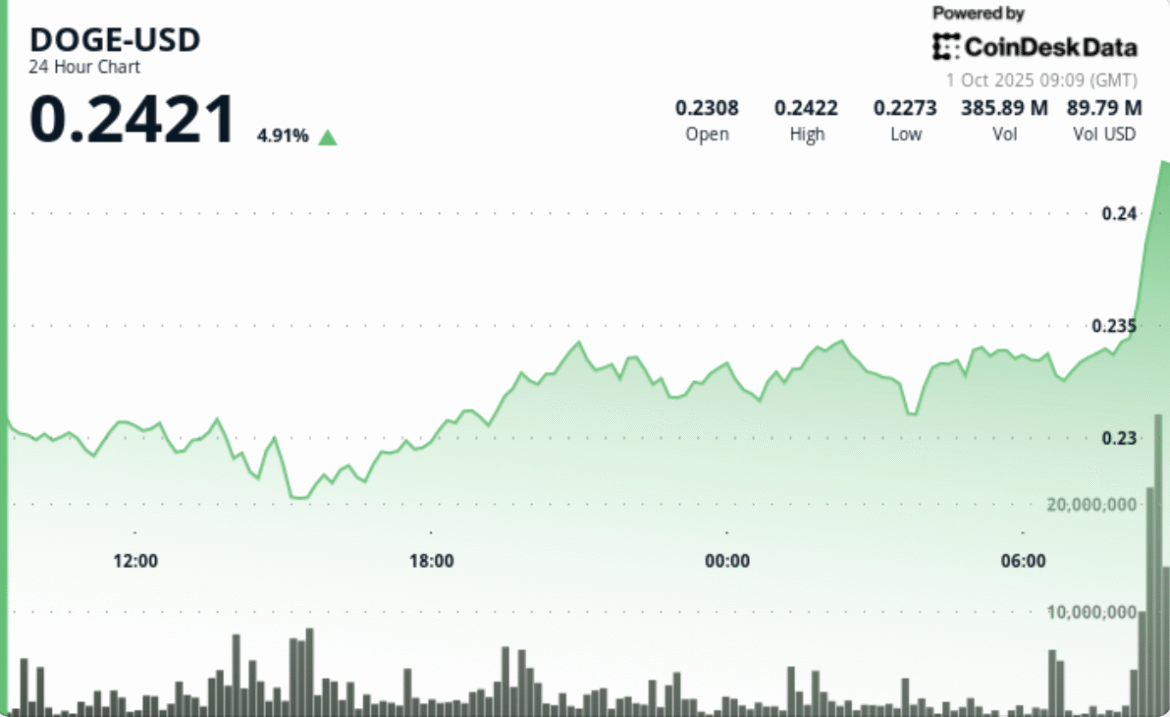

The daily timeframe chart shows that the HBAR price formed a double-bottom pattern at $0.2050, its lowest level on Sept. 5 and 26. This pattern had a neckline at $0.2552.

Most importantly, the coin has formed a falling wedge pattern, which often leads to a strong bullish breakout. The lowest point of this wedge is between the 50% and 61.8% Fibonacci retracement levels. This wedge is also part of the second phase of the Elliott Wave pattern. The first wave happened between June 24 and July 26, when the token jumped by 140%.

Therefore, the coin will likely move to the third phase, which is usually the longest and the most bullish.

The first target will be the year-to-date high of $0.3065, which is about 40% above the current level. A move above that level will point to more upside, potentially to last November’s highest point at $0.4000.

The bullish HBAR price forecast will become invalid if the coin drops below the double-bottom point at $0.2050.

HBAR price chart | Source: crypto.news

HBAR to benefit from the crypto ETF season

Eric Balchunas, the senior ETF analyst at Bloomberg, believes that the crypto ETF season is starting as the Securities and Exchange Commission prepares to approve or deny more than 70 applications.

The agency has already provided listing standards for these ETFs, raising the possibility that many of them will be approved soon.

Hedera is one of the cryptocurrencies that will benefit from the ETF season, as the SEC has been reviewing the Grayscale Hedera ETF since 2024, and the final deadline will be in November.

Chances are that the approval will happen earlier than that, especially if it approves other ETFs whose deadline is coming up soon. HBAR will likely continue rising ahead of the ETF approval as investors anticipate more demand from American investors.