This free-to-access article was made possible by Tom’s Hardware Premium, where you can find in-depth news analysis, features and access to Bench.

Nearly every analyst firm and memory maker is now warning of looming shortages of NAND and DRAM that will result in skyrocketing pricing for SSDs and memory over the coming months and years, with some even predicting a shortage that will last a decade. The looming shortages are becoming increasingly impossible to ignore, and the warnings from the industry are growing increasingly dire, as the voracious appetite of AI data centers begins to consume the lion’s share of the world’s memory and flash production capacity.

The shift has its roots in the cyclical nature of memory manufacturing, but is amplified this time by the extraordinary demands of AI and hyperscalers. The result is a broad supply squeeze that touches every corner of the industry. From consumer SSDs and DDR4 kits to enterprise storage arrays and bulk HDD shipments, there’s a singular throughline: costs are moving upward in a convergence that the market has not seen in years.

Don’t miss these

From glut to scarcity

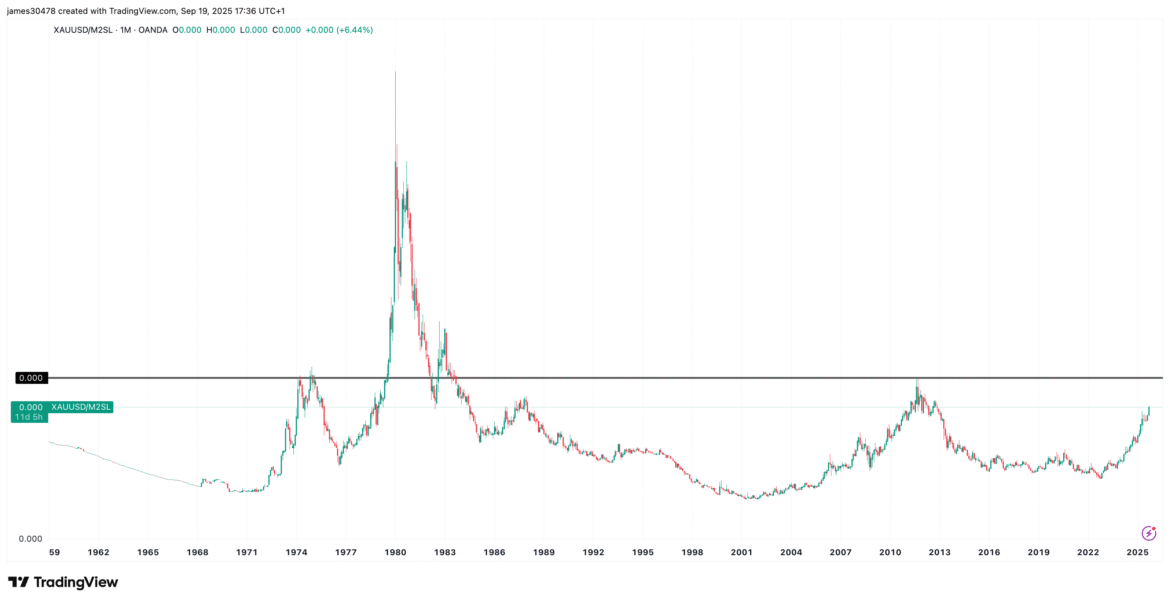

The downturn of 2022 and early 2023 left memory makers in dire straits. Both NAND and DRAM were selling below cost, and inventories piled up. Manufacturers responded with drastic output cuts to stem the bleeding. By the second half of 2023, those reductions had worked their way through to sales channels. NAND spot prices for 512Gb TLC parts, which had fallen to record lows, rose by more than 100% in the span of six months, and contract pricing followed.

That rebound quickly showed up on retail shelves. Western Digital’s 2TB Black SN850X sold for upwards of $150 in early 2024, while Samsung’s 990 Pro 2TB went from a holiday low of around $120 to more than $175 within the same timeframe.

The DRAM market’s trend lagged behind NAND by a quarter, but the pattern was the same. DDR4 modules, which appeared to be clearance items in 2023, experienced a supply crunch as production lines began to wind down. Forecasts for Q3 2025’s PC-grade DDR4 products were set to jump by 38-43% quarter-over-quarter, with server DDR4 close behind at 28-33%. Even the graphics memory market began to strain. Vendors shifted to GDDR7 for next-generation GPUs, and shortfalls in GDDR6 sales inflated prices by around 30%. DDR5, still the mainstream ramp, rose more modestly but showed a clear upward slope.

Hard drives faced their own constraints. Western Digital notified partners in April 2024 that it would increase HDD prices by 5-10% in response to limited supply. Meanwhile, TrendForce recently identified a shortage in nearline HDDs, the high-capacity models used in data centers. That shortage redirected some workloads toward flash, tightening NAND supply further.

AI’s insatiable appetite

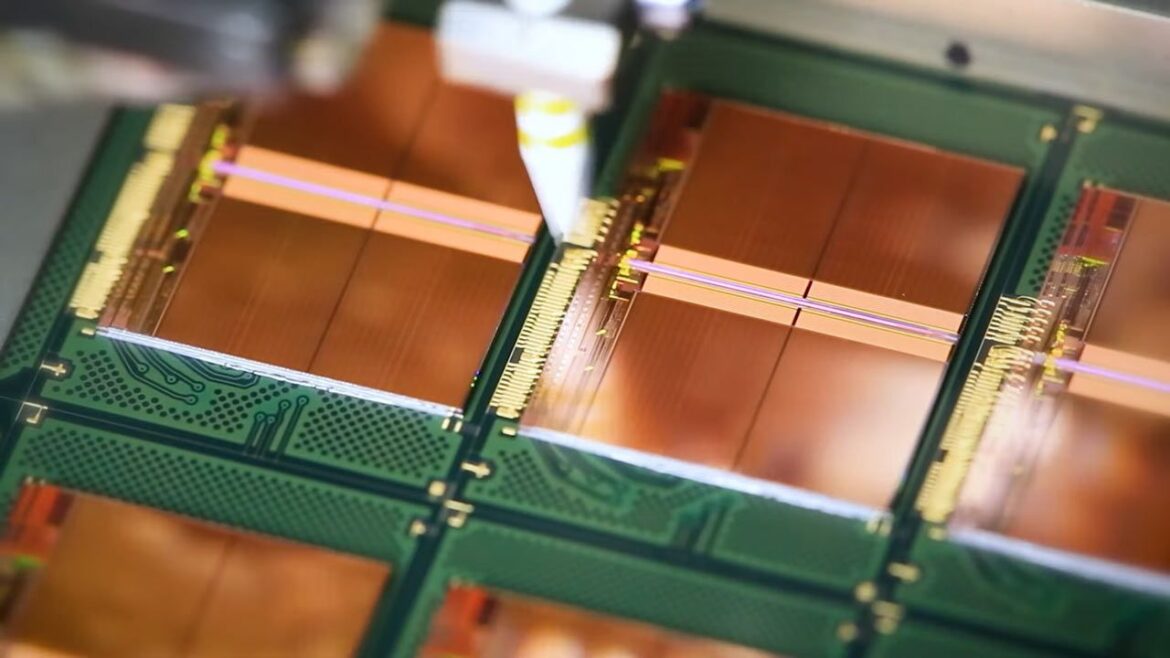

(Image credit: ServeTheHome)

Every memory cycle has a trigger, or a series of triggers. In past years, it was the arrival of smartphones, then solid-state notebooks, then cloud storage. This time, the main driver of demand is AI. Training and deploying large language models require vast amounts of memory and storage, and each GPU node in a training cluster can consume hundreds of gigabytes of DRAM and multiple terabytes of flash storage. Within large-scale data centers, the numbers are staggering.

OpenAI’s “Stargate” project has recently signed an agreement with Samsung and SK hynix for up to 900,000 wafers of DRAM per month. That figure alone would account for close to 40% of global DRAM output. Whether the full allocation is realized or not, the fact that such a deal even exists shows how aggressively AI firms are locking in supply at an enormous scale.

Cloud service providers are behaving similarly. High-density NAND products are effectively sold out months in advance. Samsung’s next-generation V9 NAND is already nearly booked before it’s even launched. Micron has presold almost all of its High Bandwidth Memory (HBM) output through 2026. Contracts that once covered a quarter now span years, with hyperscalers buying directly at the source.

Deal alert

The knock-on effects are visible at the consumer level. Raspberry Pi, which had stockpiled memory during the downturn, was forced to raise prices in October 2025 due to memory costs. The 4GB versions of its Compute Module 4 and 5 increased by $5, while the 8GB models rose by $10. Eben Upton, the company’s CEO, noted that “memory costs roughly 120% more than it did a year ago,” in an official statement on the Raspberry Pi website. Seemingly, nothing and no one can escape the surge in pricing.

Shifting investment priorities

A shortage is not simply a matter of demand rising too quickly. Supply is also being redirected. Over the past decade, NAND and DRAM makers learned that unchecked production expansion usually leads to collapse. After each boom, the subsequent oversupply destroyed margins, so the response this cycle has been more restrained.

Samsung, SK hynix, and Micron have all diverted capital expenditure toward HBM and advanced nodes. HBM, in particular, commands exceptional margins, making it an obvious priority. Micron’s entire 2026 HBM output is already committed, and every wafer devoted to HBM is one not available for DRAM. The same is true for NAND, where engineering effort and production are concentrated on 3D QLC NAND for enterprise customers.

According to the CEO of Phison Electronics, Taiwan’s largest NAND controller company, it’s this redirection of capital expenditure that will cause tight supply for, he claims, the next decade.

“NAND will face severe shortages in the next year. I think supply will be tight for the next ten years,” he said in a recent interview. When asked why, he said, “Two reasons. First… every time flash makers invested more, prices collapsed, and they never recouped their investments… Then in 2023, Micron and SK hynix redirected huge capex into HBM because the margins were so attractive, leaving even less investment for flash.”

(Image credit: Micron)

It’s these actions that are squeezing more mainstream products even tighter. DDR4 is being wound down faster than demand is tapering. Meanwhile, TLC NAND, once abundant, is also being rationed as manufacturers allocate their resources where the money is, leaving older but still essential segments undersupplied.

The same story is playing out in storage. For the first time, NAND flash and HDDs are both constrained at once. Historically, when one was expensive, the other provided a release valve, but training large models involves ingesting petabytes of data, and all of it has to live somewhere. That “warm” data usually sits on nearline HDDs in data centers, but demand is now so high that lead times for top-capacity drives have stretched beyond a year.

With nearline HDDs scarce, some hyperscalers are accelerating the deployment of QLC flash arrays. That solves one bottleneck, but creates another, pushing demand pressure back onto NAND supply chains. For the first time, SSDs are being adopted at scale for roles where cost-per-gigabyte once excluded them. The result is a squeeze from both sides, with HDD prices rising because of supply limits and SSD prices firming as cloud buyers step in to fill the gap.

Why not build even more fabs?

(Image credit: Samsung)

Fabs are being built, but they’re expensive and take a long time to get up and running, especially in the U.S. A new greenfield memory fab comes with a price tag in the tens of billions, and requires several years before volume production. Even expansions of existing lines take months of tool installation and calibration, with equipment suppliers such as ASML and Applied Materials struggling with major backlogs.

Manufacturers also remain wary of repeating past mistakes. If demand cools or procurement pauses after stockpiling, an overbuilt market could send prices tumbling. The scars of 2019 and 2022 are still fresh in their minds. This makes companies reluctant to bet on long-term cycles, even as AI demand looks insatiable today — after all, many believe that we’re witnessing an AI bubble.

Geopolitics adds yet more complexity to the conundrum. Export controls on advanced lithography equipment and restrictions on rare earth elements complicate any potential HDD fab expansion plans. These storage drives rely on Neodymium magnets, one of the most sought-after types of rare earth materials. HDDs are one of the single-largest users of rare earth magnets in the world, and China currently dominates the production of these rare earth materials. The country has recently restricted the supply of magnets as a retaliatory action against the U.S. in the ongoing trade war between the two nations.

Even if the capital were available, the supply chain for the required tools and materials is itself constrained. Talent shortages in semiconductor engineering slow the process even further. The net result is deliberate discipline, with manufacturers choosing to sell existing supply at higher margins rather than risk another collapse.

(Image credit: Samsung Semiconductor Global)

Unfortunately, manufacturers’ approaches to the matter are unlikely to change any time soon. For consumers, this puts an end to ultra-cheap PC upgrades, while enterprise customers will need larger infrastructure budgets. Storage arrays, servers, and GPU clusters all require more memory at a higher cost, and many hyperscalers make their own SSDs using custom controllers from several vendors. Larger companies, like Pure Storage, procure NAND in massive quantities for all flash arrays that power AI data centers. Some hyperscalers have already adjusted by reserving supply years in advance. Smaller operators without that leverage face longer lead times and steeper bills.

Flexibility is reduced in both cases. Consumers can delay an upgrade or accept smaller capacities, but the broader effect is to slow the adoption of high-capacity drives and larger memory footprints. Enterprises have little choice but to absorb costs, given the critical role of memory in AI and cloud workloads.

The market should eventually rebalance, but it’s impossible to predict when. New fabs are under construction, supported by government incentives, and if demand growth moderates or procurement pauses, the cycle could shift back toward oversupply.

Until then, prices for NAND flash, DRAM, and HDDs will likely remain elevated into 2026. Enterprise buyers will continue to command priority, leaving consumers to compete for what remains. And the seasonal price dips we took for granted in the years gone by probably won’t be returning any time soon.

Follow Tom’s Hardware on Google News, or add us as a preferred source, to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.