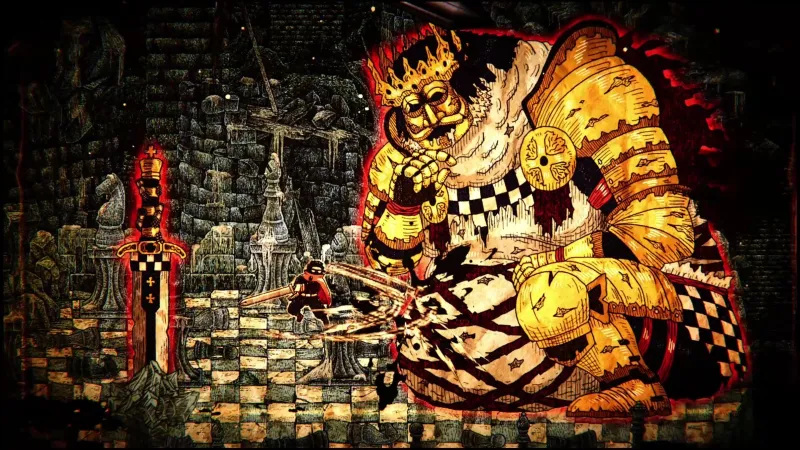

Digimon Story Time Stranger has plenty of Digimons, and you can evolve them to make your party much more powerful.

Every Digimon in the game has a specific evolution line for you to learn and master. However, the lines are locked in the beginning. This guide will help you learn more about all the evolution lines, aka digivolutions, present in the game.

Disclaimer: Work in progress.

Complete Digimon Story Time Stranger Digivolution options

The table below has all the information about the Digivolutions for every creature in Digimon Story Time Stranger.

DigimonDigivolutions1KuramonPagumon

Tsumemon2ChoromonKapurimon3DodomonWanyamon

Dorimon4PabumonMotimon

Yokomon

Tanemon5PunimonTsunomon

Nyaromon6BotamonKoromon7PoyomonBukamon

Tokomon8KapurimonHagurumon

Kokuwamon

ToyAgumon

Solarmon9KoromonAgumon

Guilmon

Dracomon

Kotemon

Betamon

Shoutmon10TanemonFunBeemon

Lalamon

Palmon

Mushroomon

Floramon11TsunomonGoblimon

Veemon

Gabumon

Ryudamon

Elecmon

Zubamon12TsumemonDracmon

Shamamon

Keramon13TokomonPatamon

Coronamon

Terriermon

Armadillomon14DorimonDorumon

Monodramon

SnowGoblimon

Lopmon15NyaromonLunamon

Kudamon

Salamon

Huckmon16PagumonImpmon

DemiDevimon

Gazimon

Otamamon17YokomonBiyomon

Penmon

Falcomon

Hawkmon

Hyokomon

Muchomon18BukamonKamemon

Crabmon

Gomamon

Gizamon

Syakomon19MotimonChuumon

Tentomon

Wormmon

Gotsumon20WanyamonGaomon

Tapirmon

Bearmon

Renamon21AgumonRaptordramon

GeoGreymon

Numemon

Greymon

Coredramon (Green)22KudamonAirdramon

Reppamon

Angemon

Ginryumon

Sorcermon23GomamonMojyamon

Ikkakumon

Frigimon

Hyogamon

IceDevimon24CoronamonFiramon

Meramon

Growlmon

BaoHuckmon

Birdramon25ZubamonMusyamon

Buraimon

Tankmon

ZubaEagermon

Ankylomon

Guardromon (Gold)26SolarmonStarmon

GoldNumemon

Meramon

Guardromon (Gold)27TerriermonMojyamon

Lekismon

Gawappamon

Gargomon28TentomonKabuterimon

Sunflowmon

Kuwagamon

Waspmon

Snimon29ToyAgumonBlimpmon

Deputymon

Raremon

Tankmon

Gargomon30TapirmonMeramon

Garurumon

Bakemon

Unimon

Kyubimon31HyokomonPeckmon

Birdramon

Dinohyumon

Buraimon32BiyomonAquilamon

Birdramon

Unimon

Wizardmon33FalcomonPeckmon

Ginryumon

Kiwimon34SalamonGatomon

Sangloupmon

Dobermon

Ikkakumon

Veedramon

Drimogemon35BearmonGrizzlymon

Gaogamon

Mojyamon

Leomon36PenmonPeckmon

Buraimon

Kiwimon

Aquilamon37MonodramonStrikedramon

Raptordramon

Deltamon

Kurisarimon

Cyclonemon38RyudamonReppamon

Coelamon

Ginryumon

Greymon

Monochromon40ElecmonAegiomon

Seadramon

Unimon

Kuwagamon

Gekomon41GaomonStrikedramon

Gaogamon

Leomon

Nanimon

Turuiemon42CrabmonGawappamon

Octomon

Shellmon

Raremon

Snimon

Coelamon43GabumonGarurumon

Ikkakumon

Drimogemon

Kyubimon

Geremon44KamemomGawappamon

Octomon

Shellmon

ShellNumemon

Dinohyumon

Sorcermon45KokuwamonCentarumon

Kuwagamon

Clockmon

Waspmon

Mekanorimon46GotsumonStarmon

Guardromon

Golemon

Monochromon

Icemon

MudFrigimon47KotemonTuruiemon

Musyamon

Deputymon

Dinohyumon

Coredramon (Blue)48ShoutmonZubaEagermon

Gargomon

Guardromon (Gold)49DracomonCoredramon (Green)

Coredramon (Blue)

Deltamon

Veedramon

Seadramon

Tyrannomon50DorrumonRaptordramon

Airdramon

Sangloupmon

ExVeemon

Drimogemon

Dorugamon51PatamonAngemon

Unimon

Centarumon52HuckmonGatomon

GeoGreymon

Growlmon

BaoHuckmon

Greymon53PalmonMojyamon

Vegiemon

Togemon

Woodmon

Kurisarimon

PlatinumSukamon54FloramonVegiemon

Togemon

Woodmon

Sunflowmon

Kiwimon55MuchomonAirdramon

Peckmon

Birdramon

Fugamon56LalamonSunflowmon

Togemon

Deputymon

MudFrigimon

Turuiemon57LunamonLekismon

Garurumon

Frigimon

Hyogamon

Sorcermon

Icemon58RenamonLekismon

Sunflowmon

Reppamon

Kyubimon59LopmonGrizzlymon

Minotarumon

Leomon

Turuiemon

Wendigomon

MudFrigimon60ImpmonBakemon

Wizardmon

Clockmon

Sangloupmon

Devimon

Witchmon61OtamammonSeadramon

Numemon

Gekomon

ShellNumemon

PlatinumSukamon62GazimonSangloupmon

BlackGatomon

Gaogamon

Dobermon

Dorugamon63GizamonCyclonemon

Flymon

ZubaEagermon

Ankylomon

Geremon64GuilmonGeoGreymon

ExVeemon

Tyrannomon65GoblimonGolemon

Wendigomon

Deltamon

Tuskmon

Ogremon66ShamamonMinotarumon

Musyamon

Fugamon

Witchmon67SyakomonCoelamon

Shellmon

ShellNumemon

Octomon

Raremon68SnowGoblimonGatomon

Monochromon

Frigimon

Hyogamon

IceDevimon

Icemon69ChuumonBlackGatomon

Sukamon

Gatomon

Gekomon

Geremon

PlatinumSukamon70DracmonSangloupmon

Sukamon

Wizardmon

Starmon71HagurumonClockmon

Mekanorimon

Tankmon

Guardromon

Blimpmon72DemiDevimonBakemon

IceDevimon

Devimon

Ogremon73FunBeemonWaspmon

Flymon

Dokugumon

Stingmon

GoldNumemon

Kabuterimon74BetamonSeadramon

Coelamon

Devimon

Numemon

Vegiemon

Tuskmon75MushroomonSukamon

Nanimon

Woodmon

Flymon76ArmadillomonGolemon

Ankylomon77VeemonExVeemon

Veedramon78HawkmonFiramon

Aquilamon79WormmonStingmon

Dokugumon

Snimon80KeramonDokugumon

Wendigomon

Mekanorimon

As mentioned above, there are more Digimons in the game. Once we figure out their Digivolutions, we will add them to the table.

Like our content? Set Destructoid as a Preferred Source on Google in just one step to ensure you see us more frequently in your Google searches!

The post All Digimon Story Time Stranger evolution lines appeared first on Destructoid.