Ethereum neared the $5,000 mark in late August, but its rally stopped short, however reaching an all-time high of $4,955 on Aug. 24.

Since this date, Ethereum has fluctuated in a range between $4,209 and $4,797, with the price failing to reach $5,000.

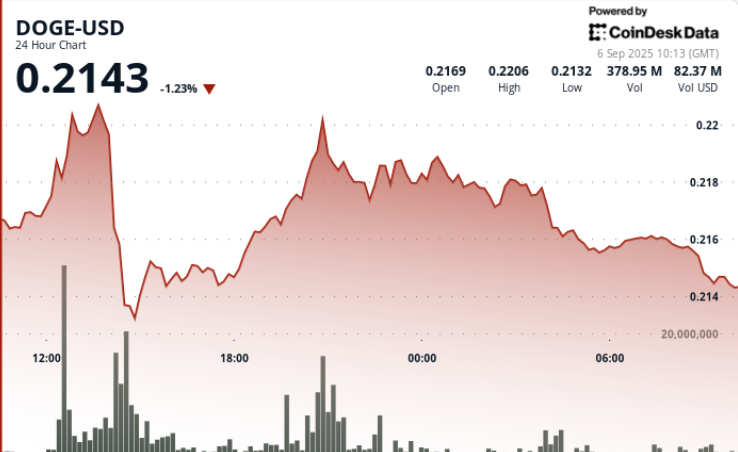

At the time of writing, ETH was trading down 3.67% in the last 24 hours to $4,295 as crypto markets fell after an initial rise in response to weak U.S. job growth that had sparked hopes for a September rate cut.

You Might Also Like

As the market awaits the next major move, analysts are hinting at indications that Ethereum might have formed a local top, beyond which upside momentum might not be feasible in the short term.

ETH Futures Under Pressure 🧨

Net Taker Volume is heavily skewed: sellers are hitting the bid with $570M more than buyers.

Historically, this level of aggressive selling has appeared near local tops. pic.twitter.com/4yqqztiRcj

— Maartunn (@JA_Maartun) September 6, 2025

According to Maartunn, a community analyst at CryptoQuant, ETH futures remain under pressure. This is as net taker volume is heavily skewed with sellers hitting the bid with $570 million more than buyers. Maartunn added that historically, this level of aggressive selling has appeared near local tops.

Ethereum ETFs see outflows

On Sept. 5, Ethereum spot ETFs saw total net outflows of $447 million, the second-largest in history and reversing a month-long trend of major inflows. Bitcoin spot ETFs recorded total net outflows of $160 million, with none of the 12 ETFs posting net inflows.

You Might Also Like

According to Glassnode, over 50% of Ethereum ETF inflows have coincided with rising CME open interest, suggesting that TradFi activity might not be purely directional. This might suggest a blend of outright exposure and arbitrage strategies as ETH trades below local highs.

In recent news, an Ethereum ICO participant has staked 150,000 ETH worth $656 million after being dormant for eight years. The participant received 300,000 ETH for $93,300 at the time of the ICO.