Earlier this week, history was made in both the world of video games and private equity. The trio of Affinity Partners, Silver Lake, and Saudi Arabia’s Public Investment Fund announced a plan to take EA private for $55bn. This leveraged buyout would be the largest in history and, if approved, will mean the industry giant would be a private company in 2027.

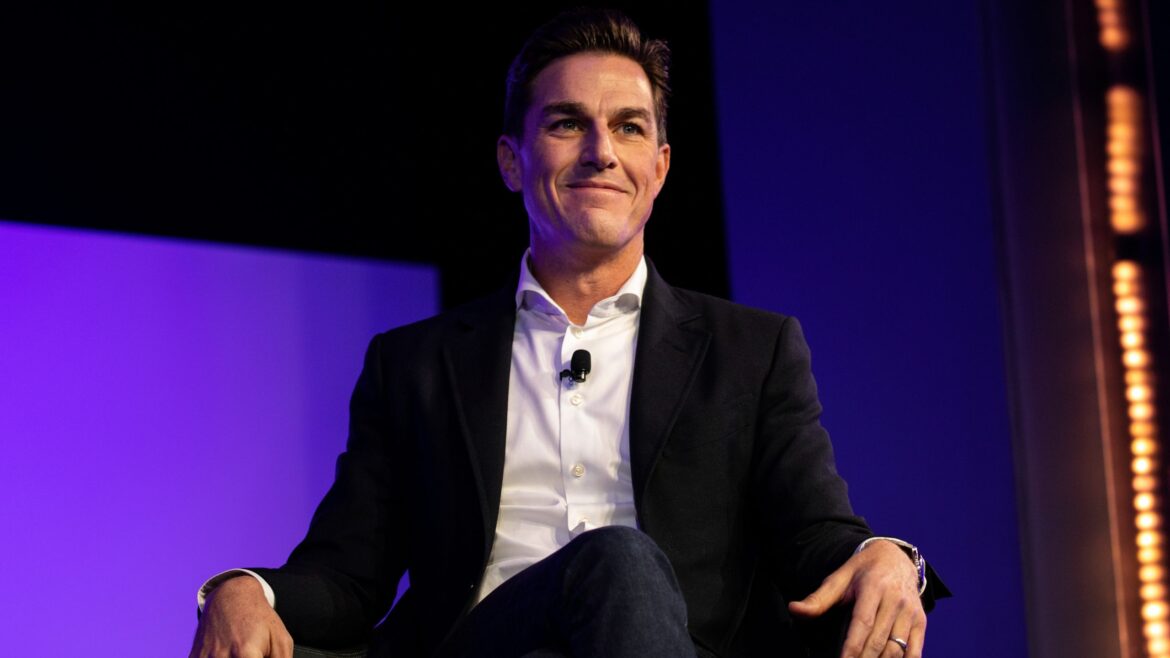

This immediately raised concerns throughout the industry. Despite a statement by EA CEO Andrew Wilson saying the company’s values would remain the same, many were concerned at the $20bn of debt the company would be saddled with. Would EA still support studios like Bioware to make the games it wants to make? Among all this, there were also concerns of a moral nature, due to the involvement of Saudi Arabia’s government in the deal.

Eurogamer spoke to Human Rights Watch’s Saudi Arabia researcher, Joey Shea, to discuss the ethical dilemma at the heart of the buyout. Human Rights Watch – which has yet to issue a comment on the deal – has comprehensively covered the ongoing human rights abuses taking place in Saudi Arabia, and how the Public Investment Fund is directly tied to such abuses.

Watch the Battlefield 6 multiplayer trailer here.Watch on YouTube

“We have found that the public investment fund has contributed to, and is responsible for, human rights abuses” states Shea. “This is a trillion dollars in Saudi state wealth that should be invested to realise the economic and social rights of Saudi citizens. We’ve found it’s been invested in vanity mega projects inside and outside of the country.

“We see this as a deliberate attempt to distract from the country’s human rights abuses […] MBS himself wields enormous power over what is effectively public funds, and he wields this power in a highly arbitrary and personalised manner, rather than the benefit of the Saudi people more broadly. Effectively, Saudi Arabia’s vast fossil fuel-derived state wealth is controlled by one person, which isn’t good for human rights, or business either.”

Saudi Arabian investment through the Public Investment fund is generally broken into two categories: investments to improve the standing of Saudi Arabia worldwide, and investments to bring foreign business and investment to Saudi Arabia itself. According to Shea, video games fall inside the former category as sports entertainment.

“Vision 2030 (a major Saudi government investment plan) is the core economic diversification plan for Saudi Arabia, and within the earliest versions of this plan it explicitly stated that these large investments in sports entertainment options was part of a strategy to enhance the reputation of the country nationally.”

After SNK was bought by Saudi Arabia, Fatal Fury City of the Wolves was used to help promote the state and its other investments. | Image credit: SNK

Some have argued that accepting Saudi Arabian investment through the PIF can be separated from the actions of its government, that no country is innocent and everything is tainted. However, according to Shea, the Saudi Arabian Public Investment Fund is directly linked to its human rights abuses. The money used for the EA buyout may itself be attached to these acts.

Shea explains: “In a report we released last year, we documented how the PIF itself has benefited from Human Rights abuses. For example, if we go back to 2017 and the notorious corruption crackdown and the Ritz Carlton, we found that assets that were seized outside of any recognisable legal process wound up in the PIF. Your investment vehicle contains assets that were stolen – that’s a problem!

“We also found that one of those assets that were seized illegally was a company called Sky Prime aviation. This is the company that owned the planes that transferred the hit squad to Istanbul where they murdered Jamal Khashoggi. So if one of the assets your investment fund owns is committing transnational murder in a consulate… that’s pretty outrageous.

“Our call is never ‘don’t invest in Saudi Arabia, don’t invest in Saudi Arabia’. We don’t have a standing boycott. But businesses have a responsibility under the UN guiding principles of Business and Human Rights to do due diligence assessments before engaging in a business relationship, to assess whether that relationship will lead to human rights harm. If it does you should, of course, not engage in that relationship.”

Once the deal goes through, all of EA’s games will be connected to the Saudi state and its human rights abuses. | Image credit: EA

One important detail within the announcement of EA’s leveraged buyout is that it’s pending regulatory approval, which some experts believe won’t be much of a hurdle due to US president Donald Trump’s son-in-law’s involvement with Affinity Partners. When asked whether a deal like this has any chance of being stopped by US regulators, Shea had little hope due to the current political climate in the region and America’s strategic partners there, Saudi Arabia included.

“I don’t see it coming under scrutiny. I think there was a moment in 2023 before October 7th, when there was some political will from some senators in the US to scrutinise Saudi investments through the PIF in the USA. There was some hope that these investments would come under greater scrutiny rather than just for national security impacts – that’s basically the only standard to which foreign investments will be scrutinised, mostly foreign investments from China.”

“We had hoped this could be broadened to include human rights concerns, but at this point, globally, I don’t personally have that much hope.”

Eurogamer contacted EA for comment on matters regarding the private buyout from Affinity Partners, Silver Lake, and Saudi Arabia’s Public Investment Fund.