Since the beginning of the month, Solana has maintained steady upward momentum, recording notable daily gains. Following its impressive price performance, popular crypto analyst Ali Martinez has suggested that the token could set a new target at $520.

Amid rising demand for the sixth-largest cryptocurrency by market capitalization, Solana has formed technical patterns that signal a potential breakout strong enough to fuel a massive rally.

Solana price outlook

The analyst shared a chart indicating that Solana could embark on a sustained bull run toward $520 if it manages to secure a weekly close above the $260 resistance level.

According to Martinez, the $520 target could be achieved within a few months, provided the asset retains its bullish momentum and maintains that crucial resistance level.

Notably, the chart highlights that while Solana reclaimed the major $230 mark today, it is now attempting to retake another key zone that has previously served as both support and resistance during periods of heightened volatility.

With an intraday high of $234, Solana is drawing closer to the $260 resistance level. If the token can build momentum and close above $260, it could unlock higher targets around $320, $400, and ultimately $520 in the longer term.

As of writing, Solana is trading at $229.14, up 1.39% over the last day and 17.84% over the last week, according to data from CoinMarketCap.

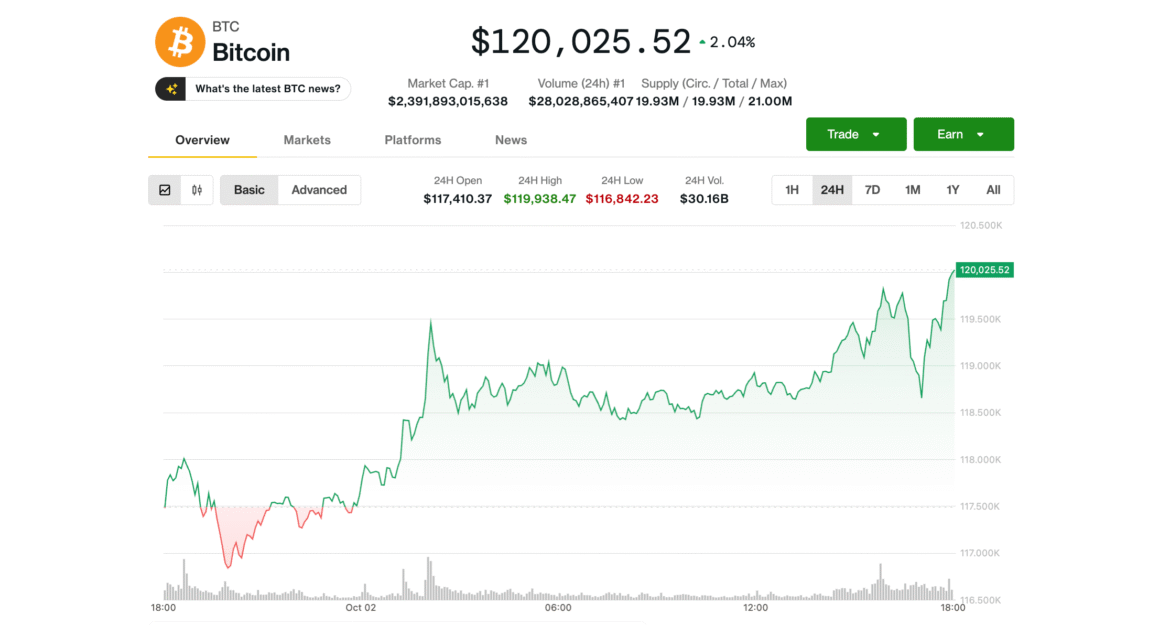

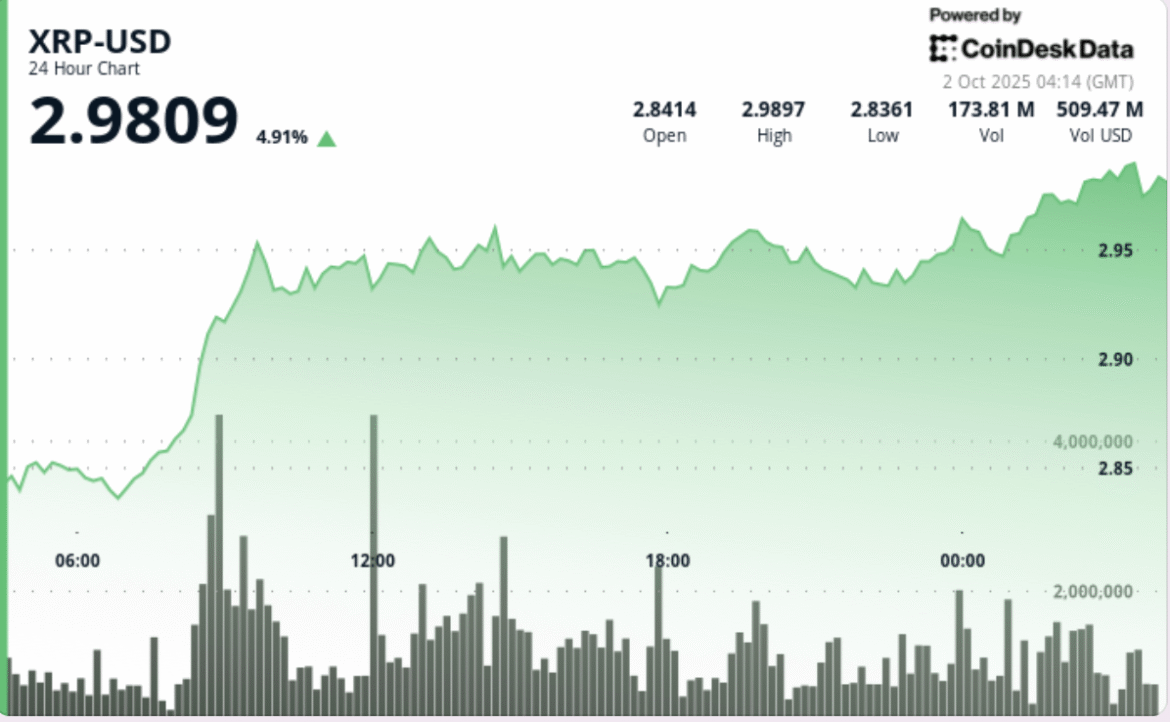

Although it remains uncertain whether Solana will sustain its bullish momentum long enough to smash these ambitious price targets, renewed market interest fueled by the Uptober rally has boosted investor confidence.

Despite broader market uncertainties, optimism about Solana’s future price potential remains strong. The blockchain continues to see major DeFi adoption from both new and existing projects, alongside growing institutional interest, spurred in part by speculation surrounding a potential spot Solana ETF. Investor sentiment has stayed bullish as confidence in the ecosystem continues to grow.