Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Market analyst James Van Straten has highlighted that open interest for BTC futures on the Chicago Mercantile Exchange (CME) is now sitting at all-time highs.

This signals increasing institutional participation and maturity for Bitcoin, as these instruments typically cushion markets from excessive volatility – exactly what deep-pocketed investors are after.

According to Straten, ‘this is how Bitcoin gets to a $10T+ market cap.‘

Keep reading as we break down why Bitcoin’s growing maturity is necessary for its growth. We’ll also point you toward the best altcoins to buy if you want to position yourself ahead of this shift.

Bitcoin’s Maturity and the Road to $10T

A big driver of Bitcoin’s maturity is the growth of derivative products like options.

By definition, an option is a contract that gives you the right but not the obligation to buy or sell an asset at a predetermined price.

Beyond the technicalities, their true role is in bringing stability, hedging strategies, and depth to the market, all of which pave the way for Bitcoin’s evolution into a full-fledged institutional asset class.

Sure, while less dramatic price swings and dampened volatility could be perceived as Bitcoin losing its trademark sheen, it’s important for us to wrap our heads around their importance.

With that in mind, now’s the perfect time to build yourself a growth-oriented crypto portfolio. Here are our top 3 suggestions.

1. Bitcoin Hyper ($HYPER) – New Bitcoin Layer-2 for Solana-Like Speed & Web3 Support

Bitcoin Hyper ($HYPER) is arguably the best crypto presale available right now.

Retail and crypto whales combined have already poured in over $18.6M into this potentially revolutionary Layer 2 solution for the Bitcoin blockchain.

$HYPER aims to finally rid the Bitcoin network of its longstanding issues: sluggish speeds, little to no scalability, and almost no Web3 support.

Unlike Bitcoin’s native layer that processes transactions one by one, $HYPER processes thousands of transactions simultaneously.

Then, it sends a summary of all those transactions to Bitcoin’s mainchain, ensuring the network’s security remains intact.

All of this is made possible via Solana Virtual Machine (SVM) integration, which also allows developers on Bitcoin to finally build smart contracts and decentralized applications.

This opens up an entirely new world of Web3 applications on Bitcoin, including DeFi trading apps, NFT marketplaces, gaming dApps, DAOs, lending, staking, and more.

To interact with these apps, all you have to do is send your Layer 1 Bitcoin to Hyper’s Canonical Bridge, which will lock those tokens and provide you with an equivalent amount of Layer 2-compatible wrapped tokens.

Currently, you can buy $HYPER for just $0.012985 apiece. And according to our Bitcoin Hyper price prediction, the token could hit $0.32 by the end of 2025 – a whopping 2,300% ROI.

Visit Bitcoin Hyper’s official website to learn more about this new BTC-centric altcoin.

2. Maxi Doge ($MAXI) – Raw Degen Energy Powering the Next Greatest Meme Coin

A well-rounded crypto portfolio should also include one or two hype-driven meme coins with the potential to go absolutely bonkers. Enter Maxi Doge ($MAXI).

Think of $MAXI as Dogecoin’s latest iteration – fierce, bulked-up, and determined to churn out 1000x gains for its investors.

Maxi’s mission is to overtake Dogecoin’s dominance as the best meme coin. Why? Because Dogecoin is his cousin – and the very reason behind his loneliness and low self-esteem growing up. And now, $MAXI wants revenge.

Naturally, a good old hero-villain story has plenty of takers, which is why the Maxi Doge presale has already pulled in over $2.5M from early investors.

Maxi’s plan involves going viral. It has reserved a massive 40% of its total token supply for marketing, covering PR campaigns, influencer collaborations, and social media blitzes.

Even better, if you’re a $MAXI holder, you’ll also gain access to exclusive weekly trading competitions and leaderboard prizes.

$MAXI doesn’t want to limit itself to just CEX and DEX listings either; it also plans to dominate the futures trading space, giving meme coin enthusiasts a real shot at outsized returns using leverage.

Right now, 1 $MAXI is available for just $0.0002595. And as per our Maxi Doge price prediction, a $100 investment today could turn into $920 by year-end. Here’s how to buy $MAXI.

Visit Maxi Doge’s official website to learn more.

3. Tutorial ($TUT) – Utility-Backed Altcoin Ready to Rally

Tutorial ($TUT) is a low-cap coin that could become the next big breakout winner, given that it’s directly tied to crypto’s growth.

It’s an AI-powered tool designed to educate people about the basics of cryptocurrency, blockchain technology, and the BNB Chain ecosystem.

Think of it as a smart tutor that guides you through things like setting up a crypto wallet, writing smart contracts, and trading on the best decentralized exchanges.

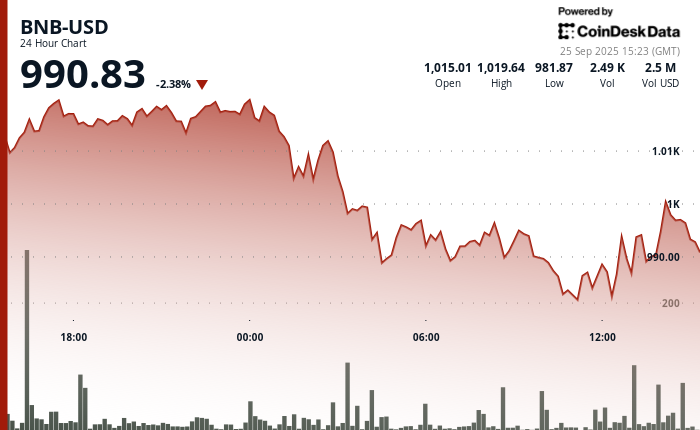

$TUT is up over 10% in the last seven days, having just broken out of a long-drawn consolidation phase that lasted nearly three months.

At the time of writing, the price is hugging the 10 EMA – a classic technical analysis signal suggesting upcoming bullishness.

Interested? Buy $TUT on Binance or any of the other crypto exchanges.

Recap: With Bitcoin’s market cap set to rocket toward $10T on the back of derivatives, now’s the perfect time to load up on low-priced, high-upside gems like Bitcoin Hyper ($HYPER), Maxi Doge ($MAXI), and Tutorial ($TUT).

Disclaimer: Crypto is highly risky, so kindly do your own research before investing. This article is not financial advice.

Authored by Krishi Chowdhary, Bitcoinist — https://bitcoinist.com/best-altcoins-to-buy-as-options-derivatives-push-bitcoin-10t-market-cap

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.