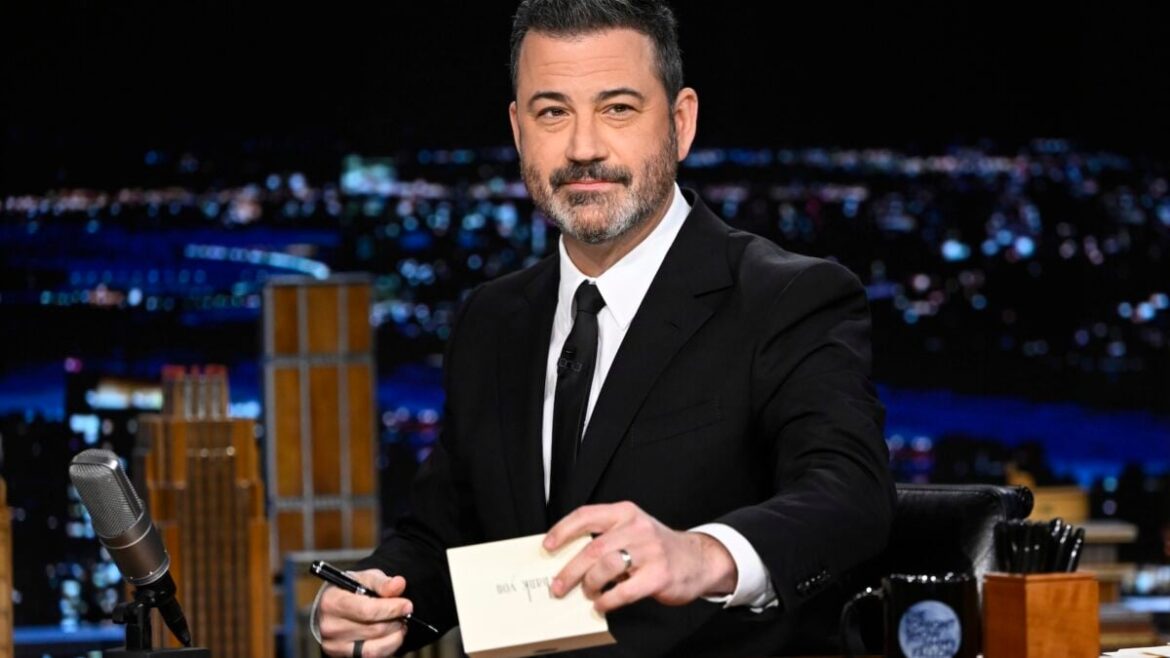

Disney lost 1.7 million paid streaming subscribers who cancelled service in the immediate aftermath of ABC pulling Jimmy Kimmel from the airwaves, according to journalist Marisa Kabas. Kimmel’s show, Jimmy Kimmel Live, was suspended for a week after President Donald Trump’s FCC pressured local TV stations to drop the late-night host, though he’s since been returned to the air.

“Disney saw more than 1.7 million total paid streaming cancelations during the period 9/17-9/23, a Disney source confirms to me. The total includes Disney+, Hulu and ESPN,” Kabas wrote on Bluesky Monday.

Kabas reports that 1.7 million was 436% above a subscriber loss that’s typical for the same period, though Disney didn’t immediately respond to Gizmodo’s questions about the report. Kabas broke a story last week in The Handbasket about a planned price increase for Disney+. Disney announced Kimmel was coming back shortly before the price increase was officially announced.

Calls to cancel Disney-owned streaming services went viral across several social media platforms as a way to express discontent with Disney’s decision. And it’s not clear how many subscribers may plan to return since Kimmel is back on the air.

Jimmy Kimmel’s show became a flashpoint for the culture wars after the murder of MAGA influencer Charlie Kirk on Sept. 10, when he was shot while speaking on a college campus in Utah. Kimmel made a comment that some interpreted as the host insisting that the shooter was a Trump supporter, even though Kimmel said it’s not what he intended.

But that comment sent off a flurry of confused outrage online, and FCC chairman Brendan Carr took the opportunity on Benny Johnson’s podcast to call Kimmel’s comment “some of the sickest conduct possible.” Carr then went on to make mobster-like threats against the TV stations that air Kimmel.

“Frankly, when you see stuff like this, I mean, we can do this the easy way or these companies can find ways to change conduct… to take action, frankly, on Kimmel or there’s going to be additional work for the FCC ahead,” said Carr.

Carr’s comments were obviously made in bad faith, but they were very predictable. President Trump celebrated Stephen Colbert’s cancellation at CBS over the summer and explicitly said that Kimmel would be “next,” along with Jimmy Fallon and Seth Meyers at NBC. Trump has seethed at comedians who make fun of him, a typical reaction among autocrats historically. And his FCC clearly feels emboldened to put pressure on media companies to get rid of any content that doesn’t fully support the president.

Trump even said on Air Force One recently that any TV network that criticizes him should lose its license, falsely insisting, “they’re not allowed to do that.” People can go on TV to criticize politicians all they like, which is considered protected speech under the First Amendment to the U.S. Constitution.

Kimmel’s show returned to the air last week and, despite a couple of days with Sinclair and Nexstar preempting the show in several markets, they eventually dropped their boycott. Local ABC affiliates in the U.S. all show Jimmy Kimmel Live now, though it seems clear that Trump and his government aren’t going to give up so easily.

Any dissent on TV is too much dissent for Trump. And the famously thin-skinned president will continue to erode freedoms in the U.S. as long as he remains in power. The only question is what lever he tries to pull next to get guys like Kimmel off the air.