Digital asset markets faced mounting pressure last week as institutional investors pulled back sharply. According to James Butterfill from CoinShares, digital asset investment products recorded $352 million in outflows.

According to the chart, a trend emerged even as weaker U.S. payroll figures raised hopes for a September interest rate cut, which usually boosts investor confidence. Trading volumes also dropped 27% week over week, indicating a cooling appetite for digital assets.

However, sentiment remains intact. Year-to-date inflows stand at $35.2 billion, which is 4.2% higher on an annualized basis compared to last year’s $48.5 billion.

Bitcoin Leads Inflows as Ethereum Faces Heavy Outflows

With $440 million in outflows, the United States stood out among the other countries. Hong Kong and Germany, on the other hand, maintained their position and brought in new investments of $8.1 million and $85.1 million. Despite the difficulties facing the market as a whole, Bitcoin managed to hold its own, generating $524 million in net inflows.

On the other hand, Ethereum faced heavy pressure. It saw $912 million pulled out over seven straight trading days, with withdrawals coming from several different investment products. Despite this, Ethereum’s total inflows for the year remain solid at $11.2 billion.

In the meantime, alternative assets like Solana and XRP continued to grow. Solana has seen 21 consecutive weeks of inflows, racking up a total of $1.16 billion, while XRP marked with $1.22 billion during the same timeframe.

Grayscale Pushes for Chainlink ETF as ETF Market Booms

Zach Rynes reported on X that Grayscale has filed an S-1 with the U.S. SEC to launch a spot Chainlink ETF. This move would convert the existing Grayscale Chainlink Trust ($GLNK), which has $28 million AUM, into a fully regulated ETF. Bitwise submitted its own S-1 for a LINK ETF in August.

🚨 JUST IN: Grayscale has filed an S-1 with the U.S. SEC to launch a spot $LINK ETF

This filing would upgrade the existing Grayscale Chainlink Trust $GLNK ($28M AUM) into an ETF

This is the second filing in recent weeks for a LINK ETF, following the Bitwise S-1 in August pic.twitter.com/OYIaCffsqF

— Zach Rynes | CLG (@ChainLinkGod) September 8, 2025

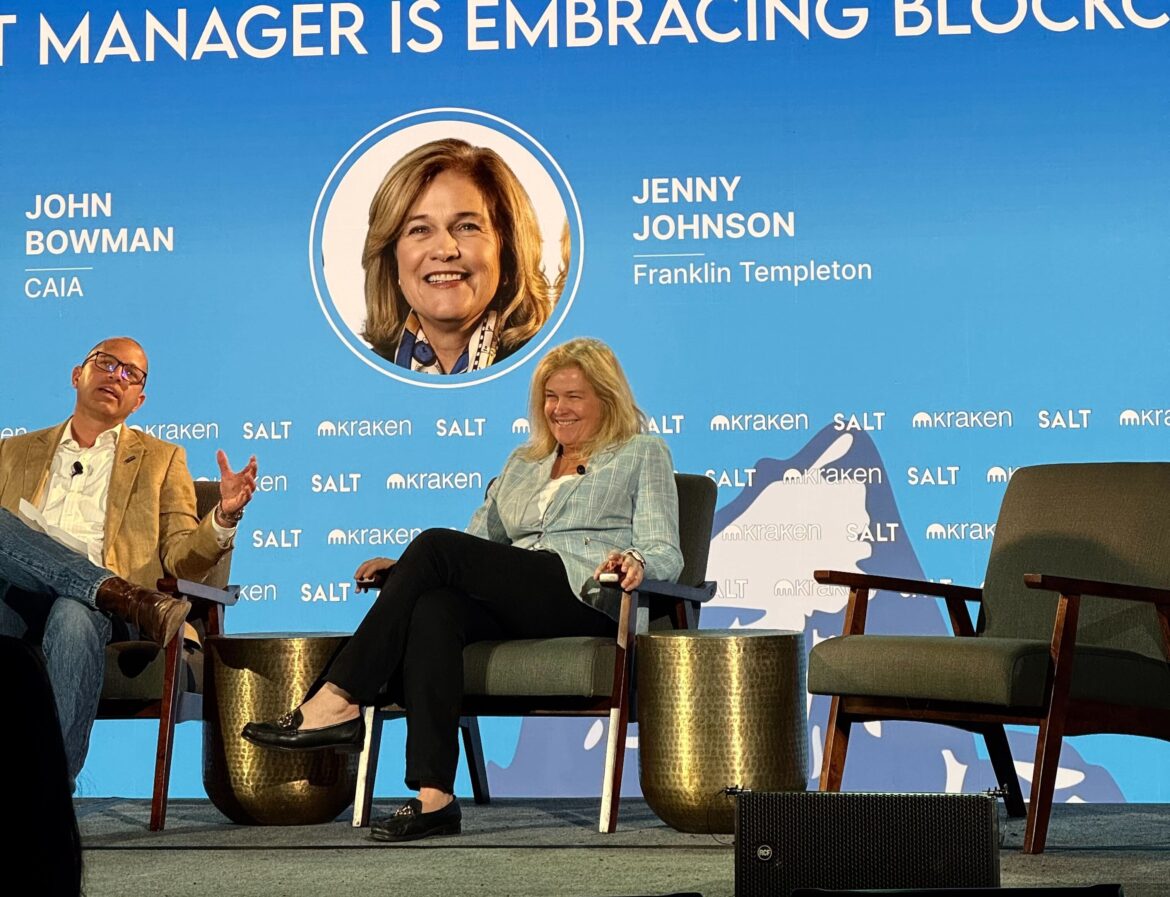

Bloomberg analyst Eric Balchunas highlighted the momentum, stating,

“ETFs crack $800b in YTD flows, that’s a breathtaking $5b/day pace… on pace to hit about $1.2T this year, a new record.”

Rising ETF activity shows increasing institutional interest, even as short-term outflows highlight investor caution in volatile crypto markets.

Also Read: Chainalysis Boosts XRPL Security With Expanded Token Monitoring