Stellar (XLM) is bullish as the asset has recorded an over 3.5% price increase within the last 24 hours, triggering a surge in open interest. As per CoinGlass data, within the same time frame, Stellar’s open interest climbed by 4.63%. This increase could catalyze further price gains.

XLM and open interest trigger

Notably, Stellar investors have committed 917.26 million XLM worth $376.97 million to the asset’s futures market. It suggests that more traders are comfortable holding positions as they anticipate further price gains in Stellar.

You Might Also Like

For clarity, open interest indicates the volume of futures contracts that investors have open on XLM. The higher the percentage increase in open interest, the higher the confidence and bullish expectations. Hence, a 4.63% increase signals strong bullish expectations.

CoinGlass data indicates that the highest number of bullish traders was recorded on Bitget, which accounts for 26.3% of the total open interest. Bitget users committed 240.97 million XLM valued at $99.15 million on Stellar.

The others completing the top three are Binance and Bybit users with 23.2% and 19.21%, respectively. In fiat terms, these committed $87.46 million and $72.45 million, in that order.

Stellar’s historical trends point to $0.50 price target

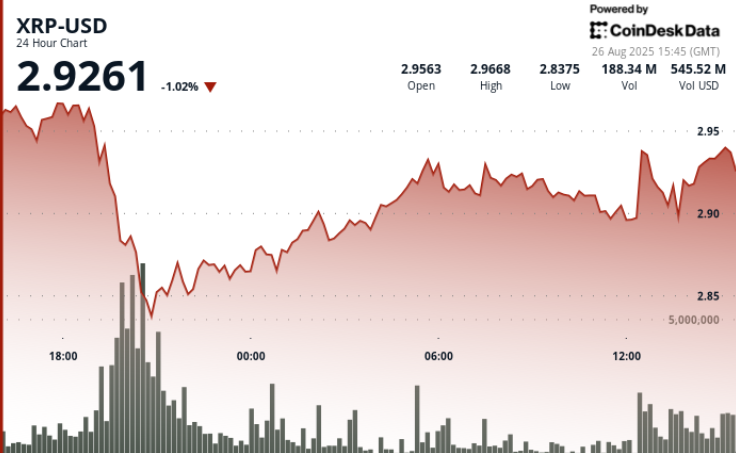

As of this writing, the Stellar price was trading up by 5.03% at $0.4113. The coin had earlier reached a peak of $0.4141, suggesting that it has potential for further gains. With its Relative Strength Index (RSI) at 57.82, XLM has room for upside, and this could reach $0.50.

You Might Also Like

A major hurdle to this target is the low trading volume, which remains in the red zone by a significant 7.35% at $299.88 million. If ecosystem bulls step in to support amid sustained open interest, Stellar could easily hit $0.50.

As U.Today reported, XLM’s price has the potential to hit this target as historical data shows a bullish September. If the coin repeats its performances of 2016, 2018, or 2022, Stellar could easily soar past the $0.50 target.