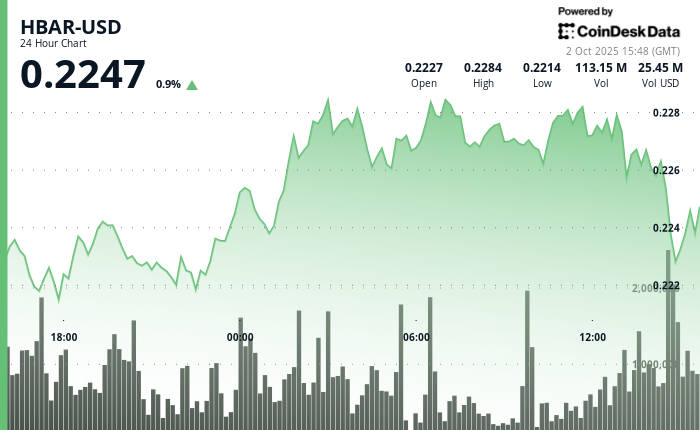

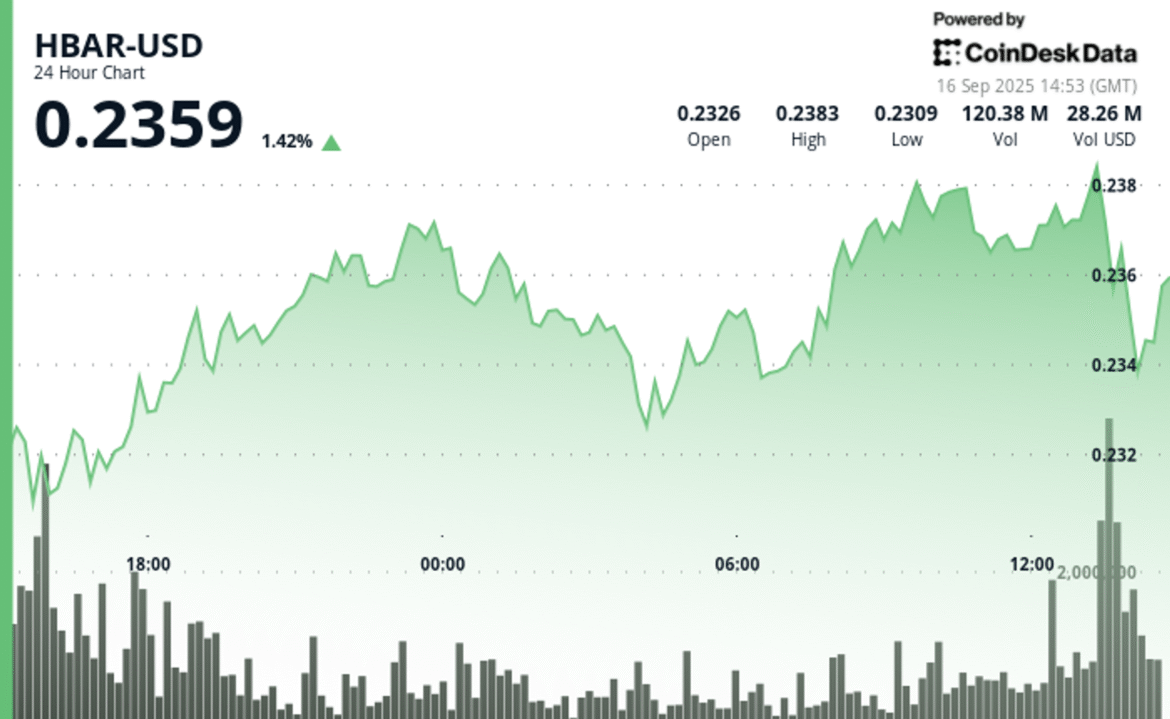

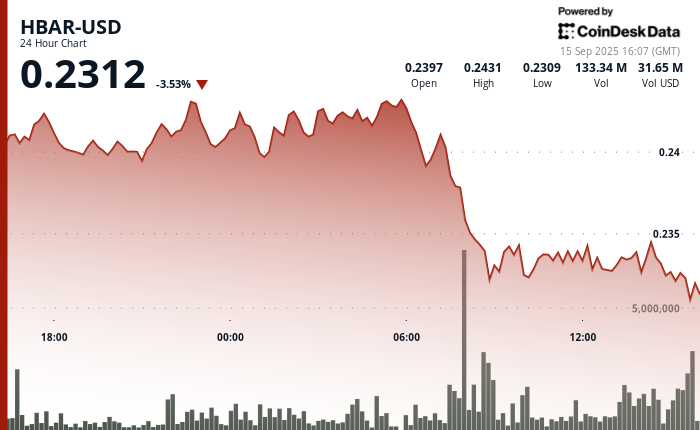

HBAR saw heightened institutional interest over the past 24 hours, trading between $0.22 and $0.23. The strongest move came early on Oct. 2, when the token surged from $0.22 to $0.23 on heavy volume of 57 million, establishing resistance at the upper level. Subsequent trading saw repeated tests of that barrier, with consolidation just below $0.23.

Late-session volatility erased gains, with a 1% drop in the final hour as selling pressure mounted and liquidity thinned. Analysts noted declining volume into the close as a sign of potential short-term weakness.

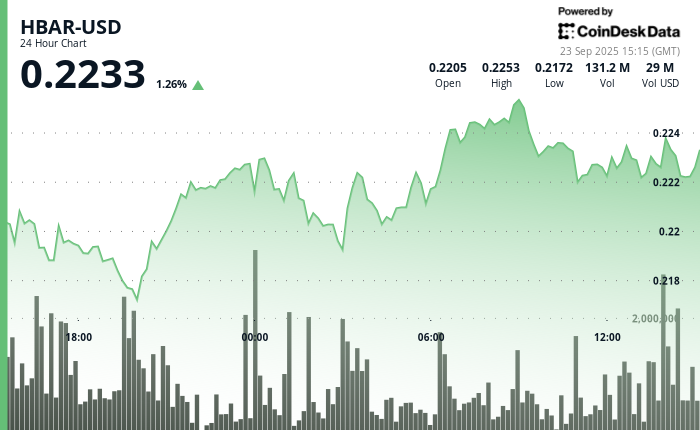

Longer-term sentiment remains more favorable. Hedera executives recently appeared on a panel with SWIFT, Citigroup, and Germany’s Bundesbank, underscoring institutional recognition of its technology. Wyoming’s Frontier Stablecoin pilot further demonstrates enterprise use cases.

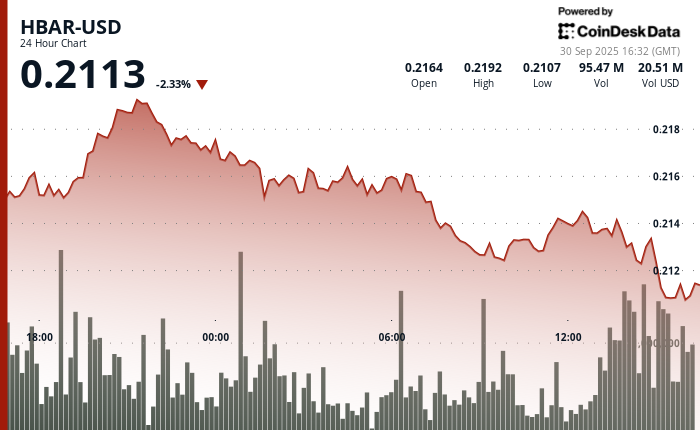

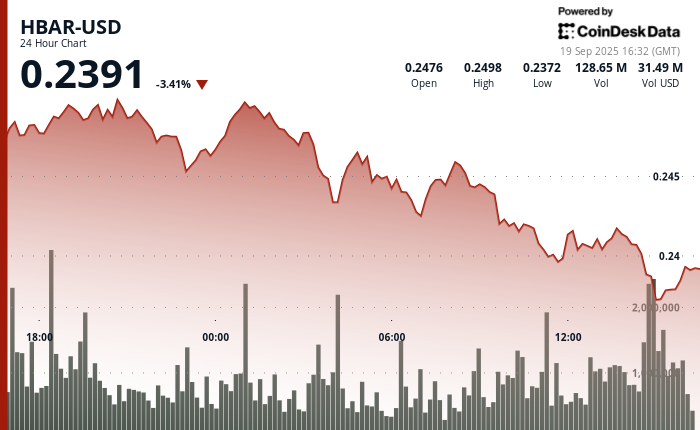

Regulatory catalysts may also be on the horizon, with the SEC reviewing a potential spot HBAR ETF this month. Despite recent declines, analysts say Hedera’s mix of partnerships and ETF prospects could support further gains in October.

HBAR/USD (TradingView)

Technical Analysis Reveals Mixed Trading Signals

- Established resistance at the $0.23 level continues to generate consistent selling pressure during periods of increased trading volume.

- Support levels near $0.23 have demonstrated resilience through multiple testing phases during the consolidation period.

- Elevated trading volume of 57.63 million shares during the early morning rally suggests institutional participation and renewed investor interest.

- Absence of trading volume in the session’s final minutes raises concerns about market liquidity and potential momentum deterioration.

- Overall trading range of $0.0068 representing 3% volatility indicates active price discovery and market efficiency.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.