- Early crypto adopters

- Gemini’s grand IPO debut

During a recent appearance on Fox Business, cryptocurrency billionaires Tyler and Cameron Winklevoss predicted that the price of Bitcoin could potentially skyrocket to $1 million “one day.”

The Winklevii are on the same page with such names as former Binance CEO Changpeng Zhao and Blockstream CEO Adam Back when it comes to their uber-bullish seven-figure prediction.

The billionaire twins argue that Bitcoin is “gold 2.0,” predicting that it is going to disrupt the market cap of the precious metal.

Early crypto adopters

Following the Facebook drama, which resulted in a multi-million-dollar settlement with founder Mark Zuckerberg, the Winklevoss twins discovered Bitcoin all the way back in 2012. Then, they used the settlement money to make a sizable investment in Bitcoin.

After the cryptocurrency experienced a notable price surge, they were among the first public figures to become Bitcoin billionaires.

The twins claim that they purchased BTC when it was trading at roughly $10, but they argue that it is still early.

You Might Also Like

Notably, they also made an appearance on the show back in October 2015 when Gemini was just launched, so the exchange is now also on the verge of celebrating its 10th anniversary.

Their Bitcoin success story is colloquially known as “the revenge of the Winklevii.”

The Gemini exchange now boasts a total of $21 billion worth of assets on its platform.

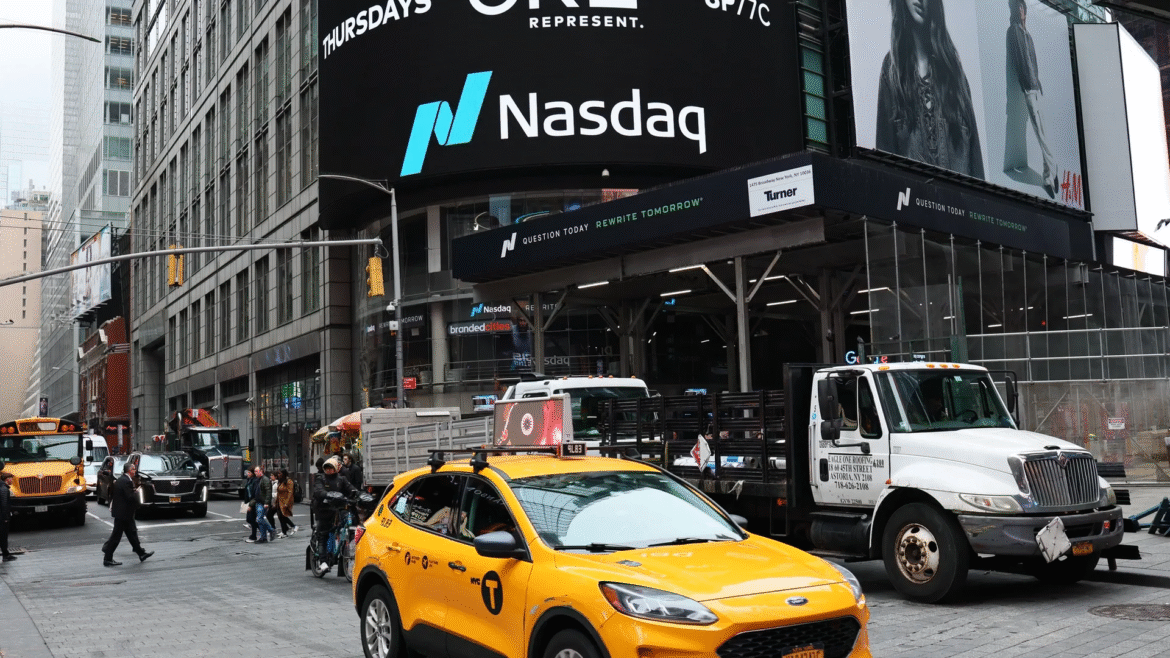

Gemini’s grand IPO debut

The exchange secured a total of $425 million with its initial public offering (IPO), which analysts have described as another win for the cryptocurrency market.

The shares of the cryptocurrency trading platform surged sharply higher on Thursday, showing that there is still plenty of investor demand for crypto companies.

This comes after stablecoin issuer Circle also had an extremely successful IPO.

Other cryptocurrency trading platforms, such as Grayscale, are also going public after the U.S. government swiftly moved to embrace the industry.