Coinbase is rolling out a new way for users to earn yields on their USDC holdings, marking one of the exchange’s first large-scale integrations with decentralized finance (DeFi) at a time of accelerating stablecoin adoption.

The company announced Thursday that it is integrating the Morpho lending protocol, with vaults curated by DeFi advisory company Steakhouse Financial, directly into the Coinbase app. The move will allow users to lend USDC (USDC) without navigating third-party DeFi platforms or wallets.

Coinbase already pays up to 4.5% APY in rewards for holding USDC on its platform. With the new DeFi lending option, however, users can tap into onchain markets and potentially earn yields of up to 10.8% as of Wednesday, according to Coinbase.

“Coinbase is only integrated with one lending protocol (Morpho) for this offering,” a company spokesperson told Cointelegraph. “We recommend that users understand the risks of lending, which are outlined in the Coinbase app experience.”

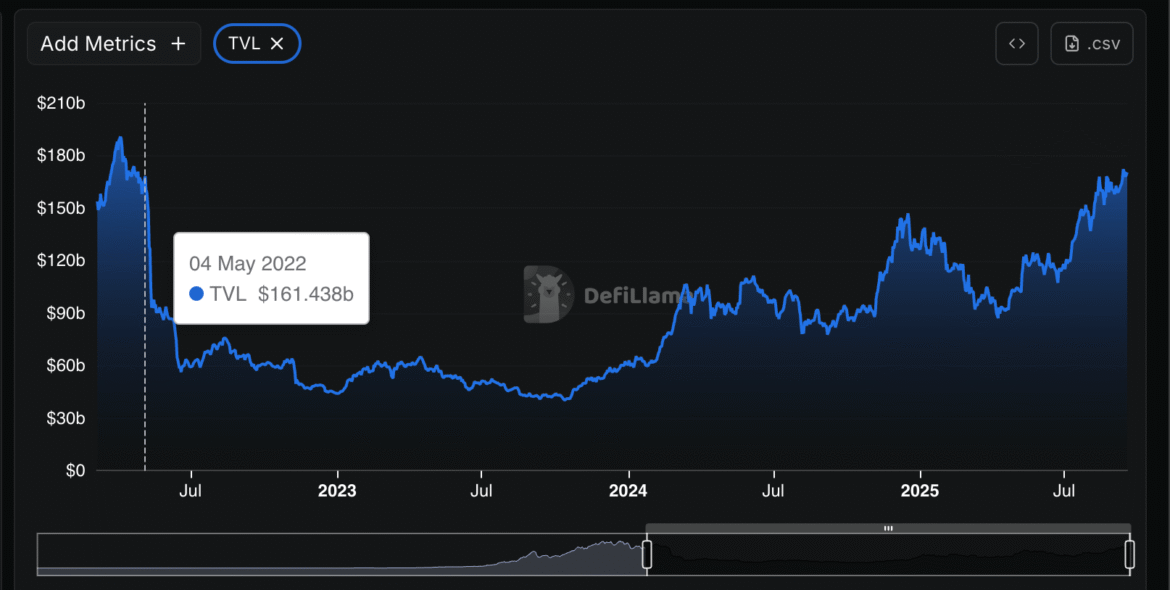

Morpho ranks among the largest decentralized lending protocols in crypto, with more than $8.3 billion in total value locked (TVL), according to DefiLlama. The protocol’s dollar-denominated TVL has climbed sharply this year, reflecting growing demand for onchain lending.

Morpho TVL statistics. Source: DefiLlama

The Morpho integration with Coinbase comes as more Americans express interest in using DeFi platforms amid a friendlier regulatory backdrop. A recent survey of 1,321 US adults conducted for lobbying group DeFi Education Fund found that 40% would be open to using such protocols if pending crypto legislation were enacted into law.

Among institutional circles, DeFi lending has jumped 72% year-to-date, according to Binance Research.

DeFi lending protocols, including Morpho, have experienced a significant surge among institutional investors. Source: Binance Research

Related: The intersection of DeFi and AI calls for transparent security

Stablecoin yield ban under fire as industry challenges perceived GENIUS Act loophole

DeFi lending for yield differs from simply earning passive interest on stablecoin holdings — a distinction that has become increasingly contentious since the passage of the US GENIUS Act, which explicitly bans yield-bearing stablecoins.

In August, the Bank Policy Institute (BPI) — a lobbying group backed by major US banks — urged regulators to close what it described as a loophole that might permit exchanges or affiliates to provide yield through third-party partners.

Source: Bank Policy Institute

“Bank deposits are an important source of funding for banks to make loans, and money market funds are securities that make investments and subsequently offer yield. Payment stablecoins serve a different purpose, as they neither fund loans nor are regulated as securities,” BPI said in a statement.

The pushback comes as stablecoin adoption accelerates, with circulating supply recently surpassing $300 billion, according to CoinMarketCap.

Coinbase, meanwhile, rejected claims that dollar-pegged stablecoins undermine traditional banking. “Stablecoins don’t threaten lending — they offer a competitive alternative to banks’ $187 billion annual swipe-fee windfall,” the exchange wrote in a Tuesday blog post.

Related: Crypto Biz: IPO fever, Ether wars and stablecoin showdowns