Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

In the midst of heightened market volatility, Tron has once again captured global attention by securing a landmark partnership with the US Department of Commerce. The agency announced today that it has selected the blockchain as one of the primary networks for posting official economic data, beginning with the release of the second quarter gross domestic product (GDP) figures.

This marks the first time that official US GDP data has been published on a public blockchain, a move that underscores the growing role of decentralized technology in enhancing transparency and global accessibility of critical economic indicators.

For Tron, this partnership is more than symbolic—it highlights the network’s ability to deliver scalability, speed, and trust at a time when blockchain use cases are expanding rapidly. Processing billions in daily settlement volume and millions of transactions, Tron has steadily built a reputation as one of the most active and reliable chains in the industry.

By becoming an infrastructure partner for one of the world’s largest economies, Tron strengthens its position as a critical player in the future of data security and blockchain adoption. This development comes as the broader crypto market heats up, adding momentum to its long-term growth narrative.

US GDP Data Anchored on TRON Blockchain

In its latest press release, TRON confirmed a historic milestone for blockchain adoption: for the first time, a US federal agency has published official GDP data on public blockchains. The Bureau of Economic Analysis (BEA) reported a Q2 2025 GDP growth rate of 3.3 percent on an annualized basis, with the corresponding data hash permanently recorded on TRON.

The transaction hash — 3f05633fb894aa6d6610c980975cca732a051edbbf5d8667799782cf2ae04040 — now serves as an immutable record, ensuring that the information remains transparent and accessible to the public.

The US Department of Commerce selected TRON to record the SHA256 hash of the official GDP release, recognizing the network’s ability to deliver unparalleled scalability, speed, and efficiency.

TRON’s performance metrics underscore its readiness for this role. With more than $22 billion in daily settlement volume and over 8.8 million daily transactions, the network has established itself as one of the busiest and most reliable blockchains globally. Beyond serving as a financial settlement layer, TRON is now positioned as infrastructure for governments and institutions.

This partnership highlights a turning point for blockchain’s utility. TRON is proving that decentralized networks can safeguard sensitive data while granting global, open access. As markets continue to evolve, the integration of TRON into official economic reporting sets a precedent for how blockchain can reshape transparency, trust, and access to critical information worldwide.

TRX Testing Strength Amid Consolidation

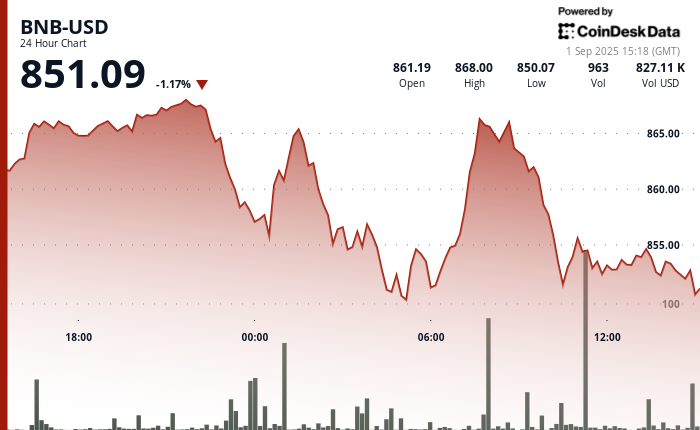

TRON (TRX) continues to trade in a strong uptrend despite recent volatility, holding above the $0.33 level. The chart shows that TRX has maintained its bullish momentum since early 2025, supported by consistent higher lows and strong buying interest. After peaking near $0.36, the price has entered a short-term consolidation phase, with bulls working to defend key support levels around the 50-day moving average at $0.29.

TRX testing previous resistance as support | Source: TRXUSDT chart on TradingView

The moving averages reflect a healthy structure, with the 50-day positioned above the 100-day and 200-day, signaling that the broader trend remains intact. TRX’s ability to hold above these moving averages highlights the resilience of buyers, even as the broader market faces heightened volatility. If momentum strengthens, a breakout above $0.36 could open the door toward retesting higher levels around $0.40.

However, risks remain if TRX loses its $0.33–$0.32 support zone, which could trigger a deeper correction back toward the $0.29 demand level. With TRON recently making headlines for its adoption by the US Department of Commerce, fundamentals continue to support long-term growth. For now, the market is watching closely as TRX consolidates, with the next move likely to define its direction in September.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.