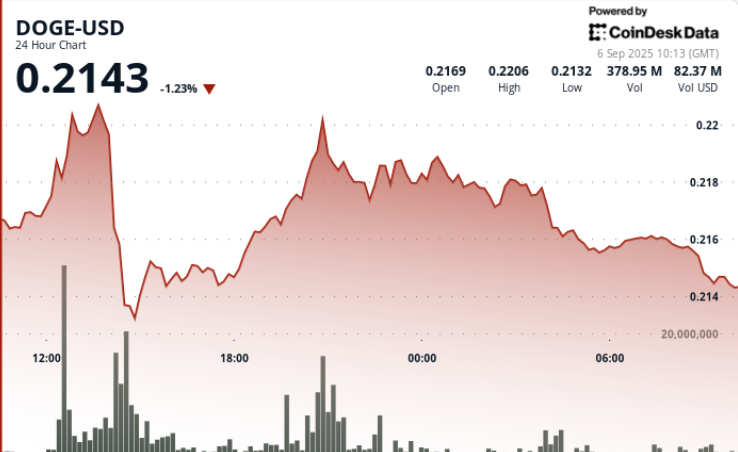

Dogecoin staged sharp price swings during the September 5–6 trading window, rising nearly 1% as volume jumped 29% above weekly averages. A midday selloff to $0.213 was quickly absorbed by buyers, underscoring institutional support and ETF-driven speculation. Traders now view $0.22 as the key breakout threshold that could define near-term momentum.

News Background

• Dogecoin reached a local high of $0.2157, its strongest level in weeks, with trading volume 29.19% above weekly benchmarks.

• Reports surfaced of a $200 million Dogecoin treasury initiative, led by Elon Musk’s legal counsel, boosting institutional credibility.

• REX Shares and Osprey Funds reportedly filed the first U.S. Dogecoin ETF applications, with decisions expected in October.

• Futures activity surged 119% in August, reflecting heightened institutional positioning around meme-based digital assets.

Price Action Summary

• DOGE traded in a $0.008 range (3.6%) between $0.213 and $0.221.

• The steepest move hit at 14:00, when price fell from $0.220 to $0.213 on 1.31B volume, establishing robust support.

• Recovery lifted DOGE back toward $0.216 by session close, with buyers consistently defending the $0.213–$0.214 zone.

• The one-hour window from 05:13–06:12 saw a resistance break above $0.2157 on 3.06M volume, hinting at renewed bullish pressure.

Technical Analysis

• Support: Strong base at $0.213–$0.214, validated by 1.3B volume during the selloff.

• Resistance: Clear ceiling at $0.220–$0.221, with multiple rejections.

• Momentum: Breakout attempt at $0.2157 suggests bullish continuation if $0.22 clears.

• Patterns: Accumulation signs within a tight consolidation band; descending triangle on DOGE/BTC pairs broke upward (flagged by CryptoKaleo).

• Indicators: RSI steady near mid-50s (neutral-bullish); MACD histogram converging toward potential bullish crossover.

What Traders Are Watching

• Whether DOGE can sustain closes above $0.22 to trigger an extended rally.

• Institutional flows tied to the $200M treasury initiative and potential ETF approval.

• Breakout targets projected between $0.30–$0.35 if resistance clears; downside risk remains toward $0.21 support.