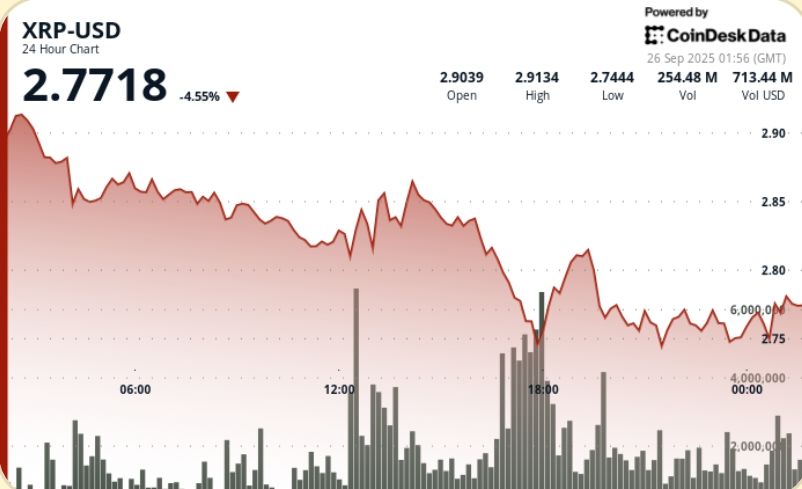

XRP’s push above $2.90 collapsed under heavy selling on Sept. 25, with a $277 million volume spike hammering price back to $2.75.

The move erased more than $18 billion in market value over the past week and confirmed fresh resistance at $2.80, leaving traders bracing for a test of $2.70 support.

News Background

• XRP slid 5.83% over the Sept. 25–26 session, falling from $2.92 to $2.75 on heavy institutional selling.

• A sharp rejection at $2.80 during the 17:00 hour triggered a 276.77 million volume spike — more than 2.5x the 24-hour average.

• Despite SEC approval of the first U.S. XRP ETF, optimism has been offset by Powell’s warnings on valuations and rising Treasury yields.

• Over the past week, XRP’s market value has contracted by $18.94 billion, down 10.22%, breaking below the $3.00 psychological threshold.

Price Action Summary

XRP traded between $2.92 and $2.74 — a 6.3% intraday range — before closing near $2.75.

• Sellers dominated after $2.80 rejection on extreme volume, creating a distribution zone that capped further upside.

• Subsequent recovery attempts stalled around $2.81–$2.82, confirming fresh resistance clusters.

• Final hour saw a brief 1.09% bounce from $2.75 to $2.78, driven by concentrated flows between 00:50–00:57 on volumes above 3 million per candle.

• Short-term support is now seen at $2.75–$2.77, with downside risk toward $2.70 if breached.

Technical Analysis

• Range: $0.18 (6.3%) between $2.92 high and $2.74 low.

• Resistance: $2.80 initial rejection; $2.81–$2.82 clusters formed on failed retests.

• Support: $2.75 zone defended in late session; $2.70 psychological level next watch.

• Volume: 276.77M at 17:00 vs. 108.42M daily average.

• Pattern: High-volume rejection signals distribution. Short-term consolidation near $2.77 suggests indecision before next move.

What Traders Are Watching

• Whether $2.75 holds through Asia session or breaks toward $2.70.

• ETF optimism versus real money outflows — sell-the-news pattern remains in play.

• Whale flows after $800M in transfers over past week; positioning risk if selling resumes.

• Macro overhang: Powell’s hawkish tone, Treasury yields climbing, Fed cut expectations capped.