Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Asset management firm Strive Inc. today announced a merger with health tech firm Semler Scientific to create a new Bitcoin (BTC) treasury company that will hold more than 10,000 BTC on its balance sheet.

Strive Merges With Semler Scientific, Expands Bitcoin Holdings

According to an announcement earlier today, US politician and entrepreneur Vivek Ramaswamy’s Strive Inc. has inked a merger deal with Semler Scientific in an all-stock transaction.

In addition, Strive announced the acquisition of 5,816 BTC – purchased for a total of $675 million – at $116,047 per coin. Today’s purchase has increased Strive’s total BTC holdings significantly, pushing them to 5,886 BTC.

The merger deal with Semler Scientific represents an approximately 210% premium, equivalent to roughly $90.52 per share. These estimates are based on the trading price of Semler Scientific common stock and Strive Class A common stock as of September 19.

Essentially, each common share of Semler Scientific will be swapped for 21.05 Class A shares of Strive. Notably, Strive aimed to avoid debt-maturity risk, and subsequently pitched a “preferred equity-only” model. The company added that it aims to grow BTC per share faster than the spot BTC price.

Notably, the newly created company will hold more than 10,900 BTC on its balance sheet. While Strive made its first major BTC purchase just before the merger, Semler Scientific has been a fairly established name when it comes to companies that have adopted a Bitcoin treasury strategy.

According to data from Coingecko, Semler Scientific ranked 18th on the list of public companies that hold BTC on their balance sheets. However, following today’s announcement, the new firm could rank 13th in the updated list, behind the likes of Coinbase and Tesla.

Source: Coingecko

The merger between Strive Inc., and Semler Scientific has already been approved by the boards of directors of both firms. Commenting on the development, Matt Cole, Chairman and CEO, Strive, said:

This merger cements Strive’s position as a top Bitcoin treasury company, and we believe our alpha-seeking strategies and capital structure position us to outperform Bitcoin over the long run. This transaction showcases how we can grow Bitcoin holdings and Bitcoin per share at an unmatched pace in the industry to drive equity value accretion.

BTC Corporate Adoption Continues To Grow

Despite BTC’s recent stagnant price action, corporate adoption of the flagship cryptocurrency continues to grow at a rapid pace. For example, Japanese investment firm Metaplanet recently announced the purchase of another 136 BTC.

Similarly, Strategy added another 535 BTC to its reserves earlier this week, extending its lead as the top corporate holder of the digital asset. In the same vein, Cyprus-based Robin Energy allocated $5 million to its Bitcoin treasury strategy.

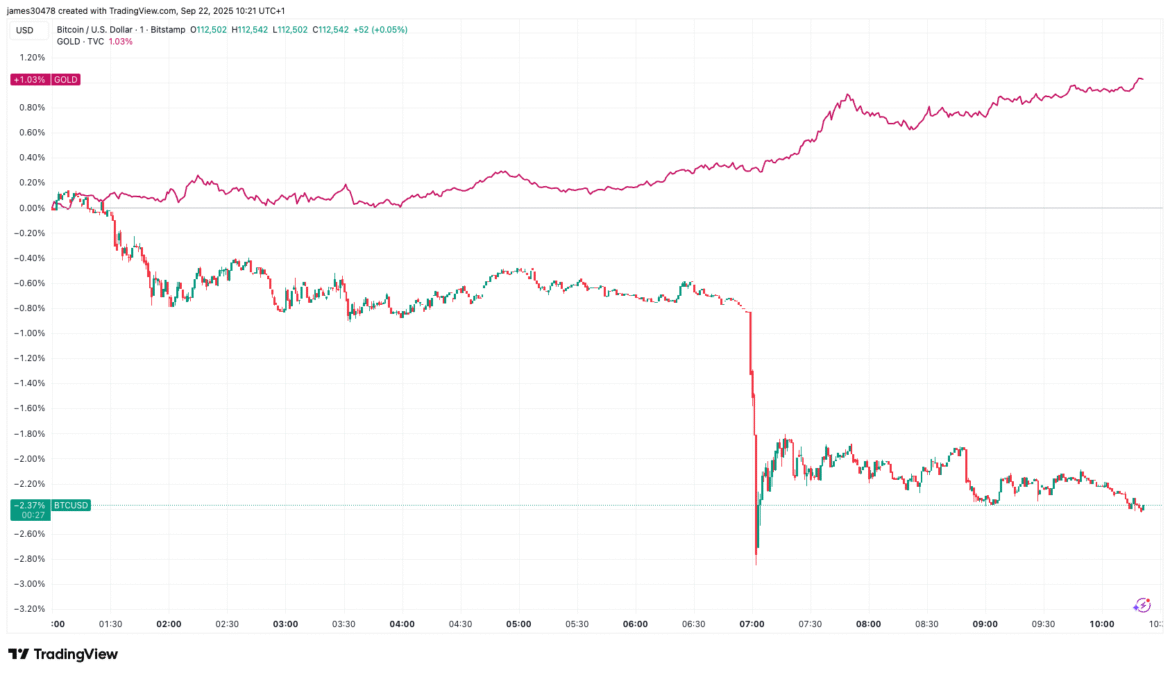

Most recently, Wall Street veteran Jordi Visser stated that the US financial firms are likely to raise their BTC allocations before the end of the year. At press time, BTC trades at 112,801, down 2.2% in the past 24 hours.

Bitcoin trades at $112,801 on the daily chart | Source: BTCUSDT on TradingView.com

Featured image from Unsplash.com, charts from Coingecko and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.