- Bitcoin’s divergence

- Ethereum not empty

After dropping below its rising trendline, which indicates a deterioration in short-term momentum, XRP is now at a pivotal point. XRP is now trading at about $2.86, having lost ground above the crucial support trendline that once directed its rally.

Although indicators suggest that buyers may be losing ground, a recovery is still possible if momentum picks back up. The Relative Strength Index (RSI), which is currently trading just below 40, is one of the best indicators. Usually, this level means that the asset is approaching oversold territory, where selling pressure might start to wear off. Notable rebounds have frequently been preceded by similar RSI readings in previous XRP cycles.

XRP/USDT Chart by TradingView

Given that the market is at a technical crossroads, the RSI indicates that a relief rally may be possible in the upcoming sessions. This mixed picture is further compounded by the consistent drop in trading volume. Since there is less conviction behind the sell-off, a relatively small amount of buying pressure could reverse the momentum and push it back upward, as indicated by the decreased participation.

In order to regain the ascending structure and pursue additional recovery, XRP may need to regain the $2.95-$3.00 zone. But hazards still exist. Now a crucial battleground, the 50-day EMA is situated just below current prices. A breakdown below this level might hasten losses in the direction of the 100-day EMA, which is located at $2.74. This area might serve as a last line of defense prior to more significant corrections.

All things considered, the XRP chart shows weakness, but not surrender. Bulls may soon have a chance to recover lost ground if the oversold RSI reading indicates that the downside momentum may soon stall. It is still possible for XRP to recover if volume increases and stays above its moving averages.

Bitcoin’s divergence

In addition to showing a pronounced bearish RSI divergence, the top cryptocurrency recently broke below its 50-day EMA, a historically significant support level. This pattern indicates that even though the price reached a new all-time high earlier this month, the underlying momentum has been gradually eroding.

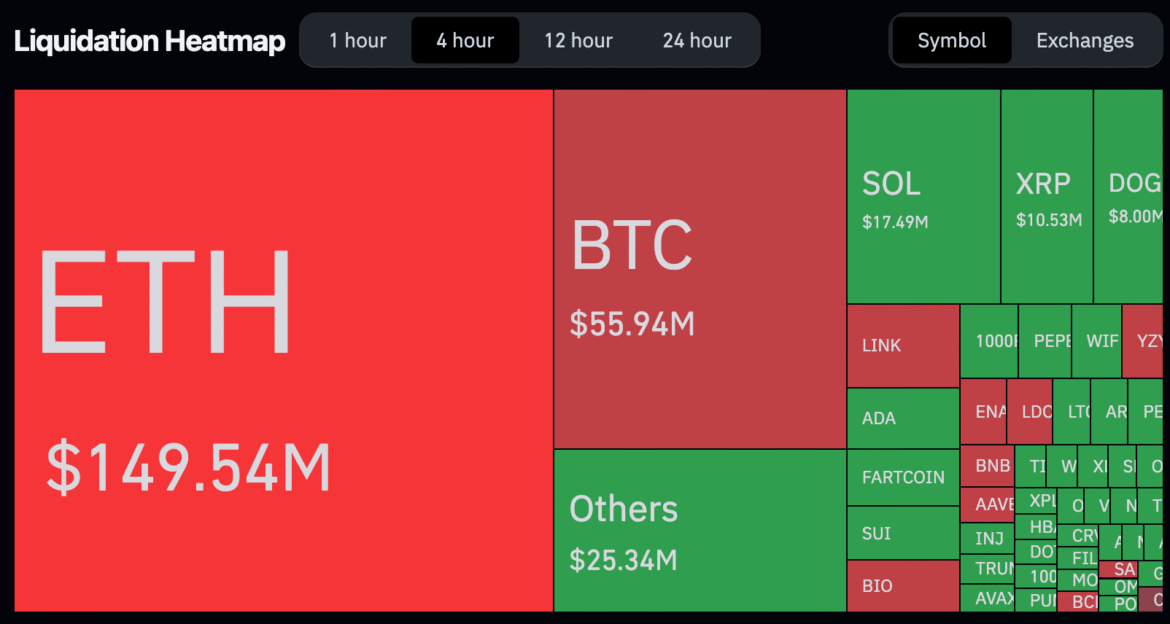

This is a risky situation that frequently occurs before lengthy corrections. Because the divergence reflects market conditions observed in June 2022, when a similar setup preceded a deep and prolonged sell-off, it is especially concerning. Even though price action initially looked bullish, the RSI trended lower in both instances as the price pushed higher, indicating that buyers were losing strength. The final collapse resulted in a series of liquidations, and the state of the market now suggests that history may repeat itself.

You Might Also Like

The apparent drop in trading volume strengthens the bearish argument. Usually, a declining volume trend during a retracement indicates that there is not enough demand at the current price levels. Given that Bitcoin is currently trading just above the 100-day EMA at $110,600, the likelihood of further declines increases in the absence of strong buyer support. The 200-day EMA, at about $103,500, might be the next crucial line of defense if this level gives way.

RSI is another warning sign, as it is currently approaching the neutral 40 zone. If it falls below 40, bearish dominance would be strengthened, which could hasten the downward trend. The market is delicately balanced in light of this, and further selling pressure could trigger a further decline.

Ethereum not empty

With Ethereum displaying resilience once more, there is conjecture that a run toward $5,000 might occur as early as September. ETH had to undergo a necessary correction after weeks of sharp increases, cooling off from its peak around $4,800. Crucially, the correction happened under control, with ETH recovering from the 26-day EMA and remaining above $4,200, a level that traders are currently targeting as short-term support. Corrections are frequently seen as a way to cool down markets, and Ethereum appears to have done so successfully.

While the recent pullback cleared out speculation and excess leverage, volume patterns indicate that sellers are waning as buyers gradually regain control. The technical room for another leg higher has been created by the RSI’s normalization after it had previously entered overbought territory. The self-driven correction in ETH’s setup is what makes it so interesting. Instead of being a panic-driven sell-off, Ethereum’s decline was more of a consolidation phase than a sudden market-wide crash. Usually a bullish sign, this type of behavior indicates that the asset is stabilizing before continuing on its current course.

You Might Also Like

The likelihood of Ethereum retesting $4,800 increases if it keeps its footing above $4,200 and buyers keep intervening. A run toward the psychologically significant $5,000 mark would then be possible if that resistance zone were broken. Ethereum is the focus of renewed investor interest as Bitcoin consolidates and altcoin momentum increases.

Even though there are no guarantees in the cryptocurrency space, the charts indicate that ETH has established a stronger base for future growth. Ethereum may finally make the much-awaited move above $5,000 in September.