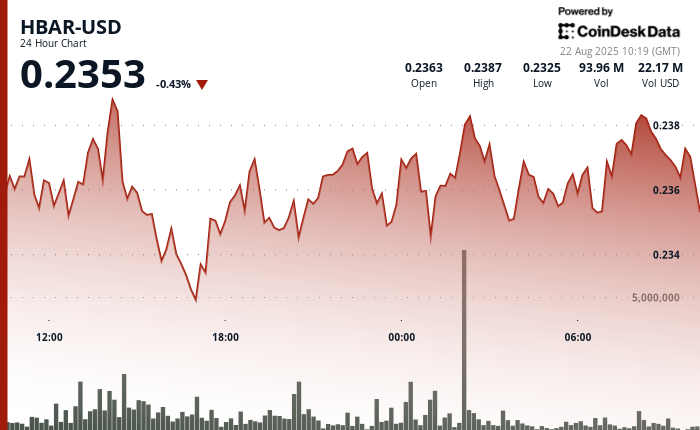

Monero price has triggered an oversold bounce after extensive selling, reclaiming critical ground. If the value area low is secured, price action could accelerate toward high time frame resistance at $344.

Summary

- Oversold Bounce: Strong reversal at $231 after losing the point of control.

- Critical Test: Price must reclaim the value area low to confirm trend reversal.

- Upside Potential: Successful reclaim could drive XMR toward $344 resistance aligned with the point of control.

Monero (XMR)’s recent price action has been shaped by a strong oversold reaction after losing the point of control and falling sharply toward platform support at $231. The subsequent bullish engulfing candles marked a significant shift in momentum, with price rebounding strongly from oversold conditions. Monero now faces the crucial task of reclaiming the value area low to confirm this reversal and sustain the move higher.

Key Monero price technical points

- Oversold Bounce at $231: Bullish engulfing candles triggered reversal after extreme selling pressure.

- Value Area Low Test: Price is attempting to reclaim this level, with rejection signaling supply remains.

- Upside Target at $344: If reclaimed, XMR could rally to high time frame resistance confluent with the point of control.

XMRUSDT (1D) Chart, Source: TradingView

The oversold bounce in XMR has provided bulls with an opportunity to regain control after weeks of heavy selling. The sharp drop began once the point of control was lost, driving price action down to the $231 support zone.

This region marked exhaustion of sellers, with demand stepping in to produce a powerful bullish engulfing reaction. From a technical standpoint, this pattern reflects an imbalance correction where oversold conditions often spark aggressive rebounds.

Price action is now consolidating near the value area low, which is acting as a short-term barrier. Multiple rejections here highlight the presence of supply, but the lack of a retracement back to $231 suggests that buyers remain in control. A decisive reclaim of the value area low would be a critical signal that demand has absorbed supply, opening the door to further upside momentum.

If this level is reclaimed, the next logical target lies at $344, a high time frame resistance that aligns with the point of control. This region represents a high-volume node where significant trading activity previously occurred, making it a likely magnet for price action.

Testing this level would confirm Monero’s transition from an oversold reaction into a full-fledged reversal trend. Traders should pay close attention to volume behavior during these moves, as sustained bullish inflows are necessary to drive price beyond resistance.

What to expect in the coming price action

Monero’s outlook hinges on its ability to reclaim the value area low. A successful retest supported by volume would validate the oversold bounce and drive price action toward $344. Conversely, repeated rejections without strong buying pressure could lead to further consolidation, with risk of revisiting $231 if momentum fades.