SINGAPORE — By the time Token2049 reconvenes next year, today’s headline‑grabbing decentralized exchanges like Hyperliquid and Aster may no longer dominate, BitMEX CEO Stephan Lutz told CoinDesk in an interview, warning that their incentive‑heavy business models are too fragile to endure.

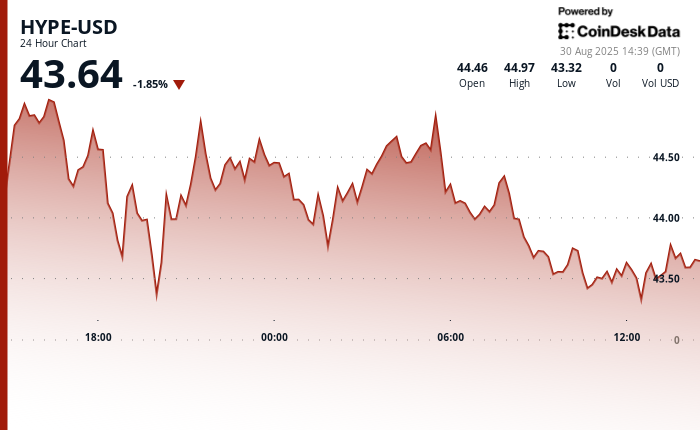

Recently, a competitive battle has erupted in the perpetual decentralized exchange (perp DEX) sector, with emerging platforms like Aster and Lighter significantly challenging Hyperliquid’s former dominance.

Last week, Aster surpassed Hyperliquid in terms of 24-hour trading volume. This has sparked a race among competitors to launch new DEXs, aiming to capture market share in this expanding field.

In this context, Justin Sun announced the launch of a new DEX at the Token2049 conference in Singapore, signaling further intensification in this rapidly evolving landscape.

The excitement, however, is likely to be short-lived, according to Lutz, who called DEXs as inherent pump-and-dump schemes.

“DEXs are about giving access to markets without intermediaries, and they build momentum by relying heavily on incentives, it’s basically an inherent pump‑and‑dump scheme,” Lutz said. “I don’t mean that in a bad way or as a scam. It’s all public, you know what you’re getting into.”

He likened the incentive programs to an advertising blitz that pays for attention, explaining that these platforms hook users with token rewards and fee rebates and then depend on that feedback loop to keep people trading.

“The question is, what sticks?” he continued.

This boom‑and‑bust cadence not only makes it hard for DEXs to retain liquidity over the long term, he added, it also means retail traders chasing outsized yields are exposing themselves to considerable volatility and risk.

In contrast to the churn he sees in DeFi, Lutz said the largest centralized exchanges, led by Coinbase and its peers, are well-positioned to ride out these cycles and remain dominant long after the latest DEX incentives subside.

He added that BitMEX’s goal is to straddle both worlds, noting that while he sees DeFi enduring and embraces it personally as a crypto native, institutions can’t interact with it like they can with a centralized exchange.

BitMEX’s Tokyo pivot

The Japanese capital, not Hong Kong or Singapore, is where the trading volume is, according to Lutz.

In August, the exchange officially moved its data infrastructure to AWS Tokyo from AWS Dublin in a move aimed at boosting liquidity. The switch has delivered the desired results, underscoring Japan’s attractiveness.

“We were in Ireland before … but it became more and more difficult because basically everyone except the U.S. players are in the Tokyo data centers,” he said.

He said the switch boosted liquidity by roughly 80% in BitMEX’s main contracts and up to 400% in some altcoin markets, gains he attributed not to market-maker intervention but to reducing latency by being in Tokyo.

Looking towards the next crypto cycle

Lutz predicts the next crypto cycle will look markedly different from prior booms and busts.

With greater institutional participation, he said, BTC could behave more like a “real asset,” smoothing out the dramatic peaks and troughs that have defined past runs.

“I expect that with greater adoption we’ll see longer plateau phases than in previous cycles; the market will still follow the same rules and characteristics, but with lower volatility as it becomes a real asset embraced by the world’s wealthy,” he said.

The bitcoin market volatility has declined markedly since the debut of spot ETFs in the U.S. last year. Moreover, BTC’s implied volatility indices have steadily evolved into VIX-like structures, moving in the opposite direction of spot prices.

All this means that even though some of these new DEXs, offering eye-watering leverage – which Lutz believes won’t last until next year – there aren’t fireworks in store for BTC. Instead, it’ll look like any other sophisticated asset class with gradual ups and downs as the market cycle continues.