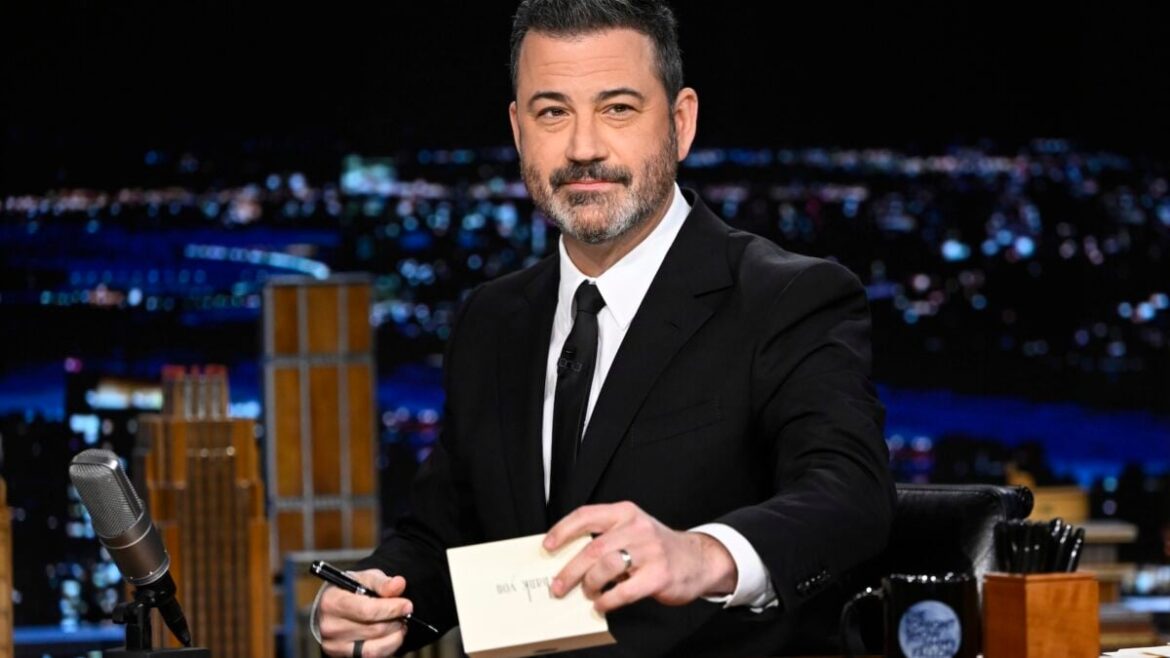

In a classic Friday news dump move, Sinclair announced that it will end its unofficial boycott of Jimmy Kimmel and will once again broadcast the comedian’s late-night show, ‘Jimmy Kimmel Live,’ to its ABC affiliate broadcast stations, ending its completely principled and not at all politically motivated stance to pre-empt the show after all of two days.

“Our objective throughout this process has been to ensure that programming remains accurate and engaging for the widest possible audience,” the company said in a statement. “We take seriously our responsibility as local broadcasters to provide programming that serves the interests of our communities, while also honoring our obligations to air national network programming.”

Sinclair—which operates 30 ABC affiliate stations in 27 markets, including cities like Portland, Baltimore, and Minneapolis—announced last week that it would choose to air “news programming” in place of Kimmel’s show, which returned to the air Tuesday after a brief hiatus. The program, which was briefly suspended by ABC after Kimmel made a frankly pretty innocuous comment about the political ideology of the person who allegedly shot and killed conservative influencer Charlie Kirk in Utah earlier this month.

Sinclair, along with fellow media conglomerate Nexstar, announced they would pull Kimmel’s show from the air following a statement from Federal Communications Commission head Brendan Carr, who warned broadcasters, “We can do this the easy way or the hard way,” and said, “These companies can find ways to change conduct to take action on Kimmel or, you know, there’s going to be additional work for the FCC ahead.”

Both companies currently have business in front of the FCC and are pretty motivated to show fealty to the Trump administration to ensure their deals get pushed through—not that they need that much motivation, considering both companies are owned by conservative-aligned media magnates. Sinclair CEO David Smith has been shifting its editorial coverage to the right for years, and Smith reportedly told Trump in 2016, “We are here to deliver your message.” Likewise, Nexstar chairman Perry Sook has repeatedly praised Trump and poured money into the coffers of GOP groups.

Sinclair attempted to get in front of the obvious criticisms that it would face as a result of both its initial decision not to broadcast ‘Jimmy Kimmel Live’ and its latest call to bring him back to the airwaves in Sinclair markets.

“Our decision to preempt this program was independent of any government interaction or influence,” the company said. “Free speech provides broadcasters with the right to exercise judgment as to the content on their local stations. While we understand that not everyone will agree with our decisions about programming, it is simply inconsistent to champion free speech while demanding that broadcasters air specific content.” It apparently took the company a solid week to remember that commitment to free speech, but it got there.

The reality is that Sinclair was going to back down eventually, if only for legal reasons. As a broadcast executive explained to Deadline, local affiliates contractually can only preempt a program so many times before it breaks the contract and loses the ability to broadcast the show entirely. Sinclair’s “principled stance” was destined to last for exactly as long as it didn’t actually cost them anything and likely not a second longer.

Once word started spreading that Disney might threaten to withhold live sports broadcasts from affiliates who pulled Kimmel, it was only a matter of time before Sinclair suddenly found its unwavering belief in “free speech” again. There may be a subset of people pissed off that Kimmel is back on Sinclair’s airwaves, but you can bet even more would be pissed if they couldn’t watch LSU play Ole Miss on Saturday. That would hurt Sinclair’s real primary principle: always maximize profits.