In brief

- Polymarket unveiled an investment from 1789 Capital.

- Donald Trump Jr. serves as a partner at the venture capital firm and is joining the prediction market’s advisory board.

- The prediction market is trying to reenter the U.S.

Donald Trump Jr. is joining Polymarket’s advisory board, the prediction market said in a press release on Tuesday, while announcing that 1789 Capital, where the U.S. president’s eldest son serves as a partner, has also made an investment in the New York-based firm.

The deal, which was first reported by Axios, was reportedly delayed until Polymarket had a clear path to reentering the U.S., while discussions between the two firms’ executives began about 18 months ago, according to an unmanned source who’s familiar with the situation.

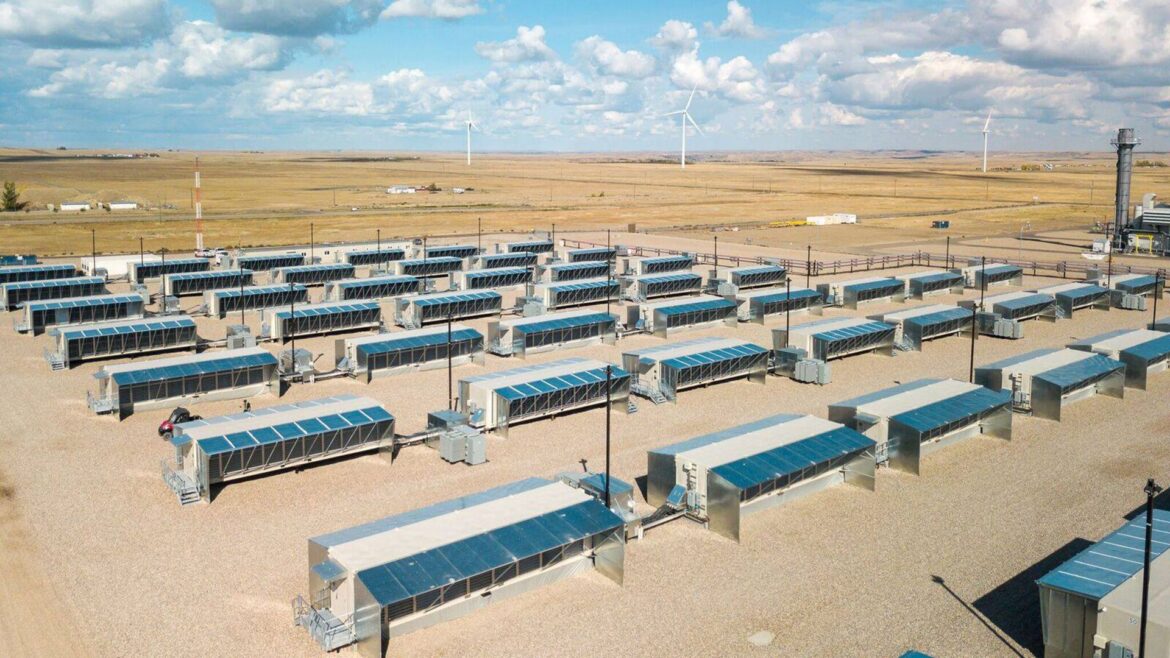

The investment, made on undisclosed terms, follows Polymarket’s acquisition of QCEX. The prediction market signaled last month that it was eyeing a return to the U.S. after acquiring the little-known derivatives exchange, and its clearinghouse, for $122 million.

In a statement, Trump Jr. described Polymarket as an “important platform” that Americans need access to, saying it helps people cut through media and political spin.

Trump Jr. has been serving as an advisor to prediction market rival Kalshi since January. He was brought on to help Kalshi with partnerships and market strategy in its efforts to expand.

Although last year’s presidential election was viewed as a tossup by pollsters, Polymarket tilted toward U.S. President Donald Trump in the race’s final months. It also foresaw then-U.S. President Joe Biden’s withdrawal from the top of the Democratic ticket.

Activity on Polymarket has cooled in recent months, but the platform registered $1 billion in trading volume in July, according to a Dune dashboard. Over the same period, it registered around 285,000 active traders.

1789 Capital is “funding the next chapter of American exceptionalism,” according to its website. The firm has made investments in firms, including SpaceX, according to PitchBook.

Some of tech CEO Elon Musk’s firms have drawn closer to Polymarket itself, including X, as the billionaire’s social media company inches toward becoming an “everything app.”

In June, X inked a partnership with Polymarket. The prediction market became X’s official platform, alongside the release of a tool for dissecting market-moving news in real time.

Authorities and regulators began scrutinizing Polymarket last year for allegedly allowing Americans to use its services, but those investigations have since been dropped. Since 2022, the company has agreed to block U.S. users, after reaching a settlement with the Commodity Futures Trading Commission for allegedly failing to register with the regulator.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.