Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

On-chain analytics firm Glassnode has revealed in a report that Bitcoin long-term holder have slowed down distribution after months of selling.

Bitcoin Long-Term Holder Net Position Change Is Now Neutral

In its latest weekly report, Glassnode has talked about how the behavior of the Bitcoin long-term holders has changed recently. The “long-term holders” (LTHs) refer to the BTC investors who have been holding onto their coins since more than 155 days ago.

Statistically, the longer a holder keeps their coins dormant on the blockchain, the less likely they become to sell them at any point. As such, the LTHs with their relatively long holding time are considered to be the diamond hands of the network.

This can make the behavior of this cohort worth keeping an eye on, as shifts in it can have consequences for the cryptocurrency as a whole, considering their standing.

There are many ways to keep track of LTH behavior, with one method being through the Net Position Change metric. This indicator measures, as its name implies, the monthly net change in the Bitcoin supply held by the LTHs as a whole.

Below is the chart for the metric shared by Glassnode that shows the trend in its value over the past year.

Looks like the value of the metric has been negative in recent months | Source: Glassnode’s The Week Onchain – Week 39, 2025

From the graph, it’s visible that the Bitcoin LTH Net Position Change was positive during the first half of 2025, but a shift occurred in July as the indicator flipped into the negative. This implies supply started exiting the cohort.

Something to keep in mind is that while selling from the group can instantly register on the chart, the same isn’t true for buying. When LTH supply rises, it doesn’t mean accumulation is happening in the present, but rather that some buying occurred 155 days ago and those coins have now been held for long enough to become a part of the group.

The LTH distribution continued through August and September, but with the start of October, the Net Position Change has returned back to a neutral value, indicating coins being sold by the group are now being balanced out by tokens maturing past the 155-day cutoff. In other words, their net profit-taking has calmed down.

As the report explains:

This cooling supply pressure suggests that the recent phase of long-term holder profit-taking may be easing, potentially leaving ETFs and new inflows as more decisive drivers of market direction.

The spot exchange-traded funds (ETFs) have also seen a shift recently, as another chart cited by Glassnode shows.

How the netflow related to the US BTC spot ETFs has changed over the last twelve months | Source: Glassnode’s The Week Onchain – Week 39, 2025

As displayed in the graph, the US Bitcoin spot ETFs switched to outflows in late September, but the netflow has once again turned green for these investment vehicles. The analytics firm notes:

Should this renewed demand align with reduced LTH selling, ETFs could provide a stabilizing force, offering a more constructive foundation for price resilience and supporting the conditions needed for a sustainable advance.

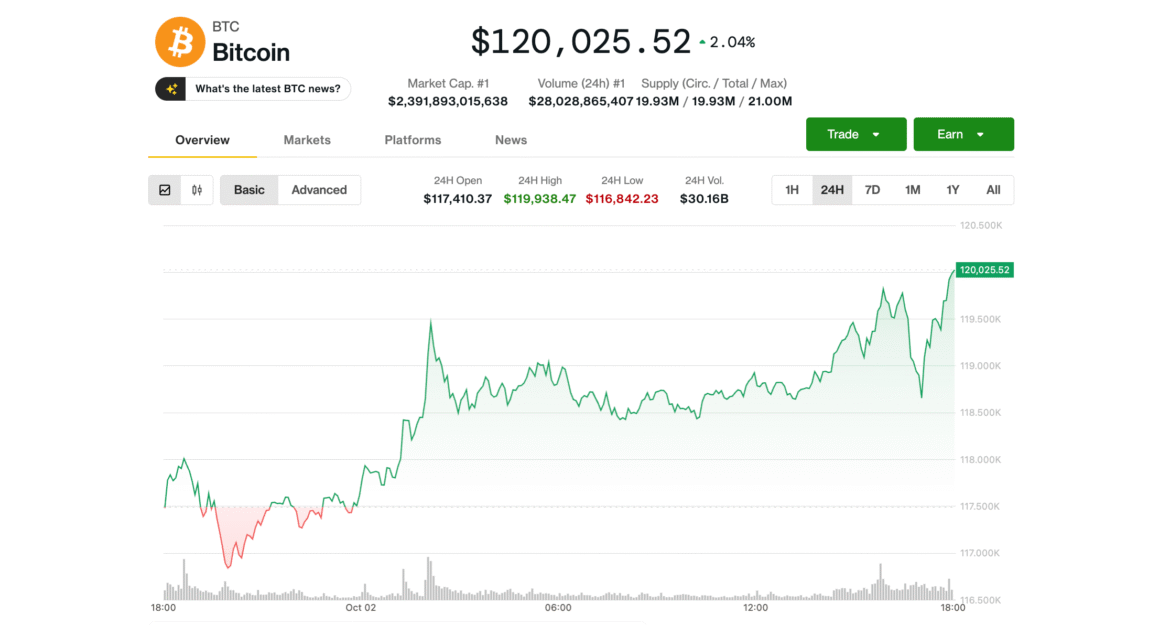

BTC Price

At the time of writing, Bitcoin is floating around $119,700, up almost 8% over the last seven days.

The trend in the price of the coin over the last five days | Source: BTCUSDT on TradingView

Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.