The majority of the coins from the top 10 list have returned to the red zone, according to CoinStats.

Top coins by CoinStats

BTC/USD

Unlike other coins, the rate of Bitcoin (BTC) has gone up by almost 1% over the last 24 hours.

Image by TradingView

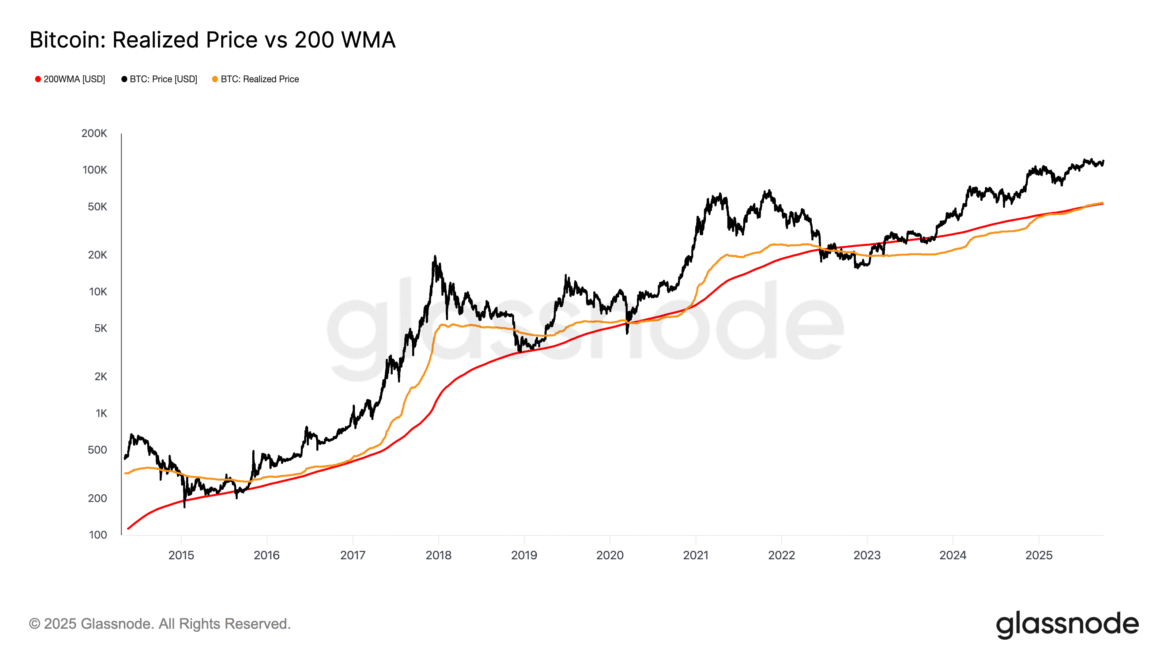

Despite today’s growth, the price of BTC is near the local support of $122,033. If bulls cannot seize the initiative, traders may expect a further decline to the $121,500 mark.

Image by TradingView

On the bigger time frame, the rate of the main crypto is approaching the all-time high of $124,517. The volume is high, which means bulls are controlling the situation on the market.

You Might Also Like

If a breakout happens, the energy might be enough for further growth to new peaks.

Image by TradingView

From the midterm point of view, the price of BTC has once again bounced off the resistance of $123,236. If buyers can hold the initiative, there is a high chance to witness a new all-time high.

Bitcoin is trading at $122,081 at press time.