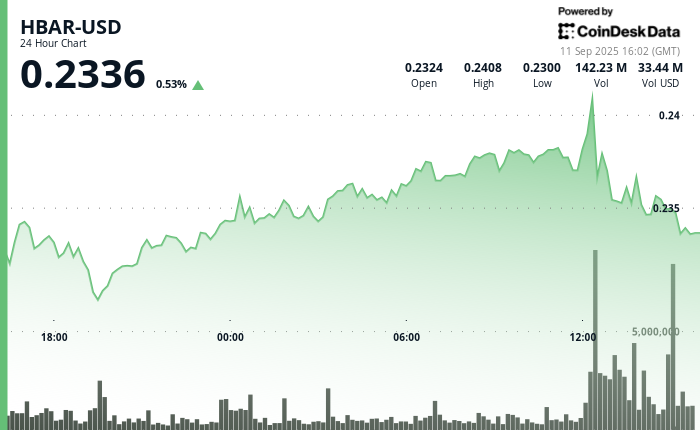

Hedera’s HBAR token saw a volatile 23-hour stretch between Sept. 10 and 11, swinging in a narrow 5% band between $0.23 and $0.24. The token dipped to its $0.23 support level early in the session before rebounding on heavier-than-usual trading volumes. Daily volume averaged 35.4 million, but activity surged to 156.1 million by midday Sept. 11 as institutional money appeared to flow in, propelling HBAR back toward the $0.24 ceiling.

Despite the rally, HBAR struggled to break through resistance at $0.24, where strong selling pressure emerged. The rejection at this technical level underscored the significance of $0.23 as firm support and $0.24 as a critical barrier for further gains. Analysts note that a close above $0.24 could open the door to a 25% rally toward the $0.25 target, but failure to breach resistance leaves the token range-bound in the $0.21–$0.23 corridor.

The surge in trading activity coincided with regulatory developments. On Sept. 9, Grayscale filed with the U.S. Securities and Exchange Commission (SEC) to convert its Hedera HBAR Trust into an exchange-traded fund (ETF), alongside similar filings for Bitcoin Cash and Litecoin. The SEC has set a Nov. 12 deadline to decide on the proposed Nasdaq listing, making the next two months pivotal for HBAR’s institutional adoption prospects.

The ETF filing has stoked demand from traditional asset managers seeking broader exposure to digital assets. With regulatory clarity on the horizon, HBAR’s price action reflects a tug-of-war between bullish institutional interest and technical barriers. Market participants will be watching closely whether the SEC’s decision provides the breakout catalyst HBAR needs to test higher levels.

HBAR/USD (TradingView)

Technical Indicators Summary

- $0.011 trading range equals 5% spread from $0.23 low to $0.24 high over 23-hour period.

- Strong $0.23 support holds on 37.8 million volume reversal.

- Breakout volume hits 156.1 million during recovery. Institutional flows confirmed.

- Key $0.24 resistance triggers massive volume reversal. Heavy selling pressure evident.

- Final hour volatility September 11 13:14-14:13 shows $0.0072 range between $0.24 levels.

- Sharp reversal at $0.24 resistance on 2.28 million volume spike creates rejection pattern.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.