In brief

- Ray Dalio said the U.S. is risking a “debt-fueled heart attack”

- The value of money would be negatively affected if the Federal Reserve is eventually forced to intervene in the bond market.

- He compared digital assets to hard currencies.

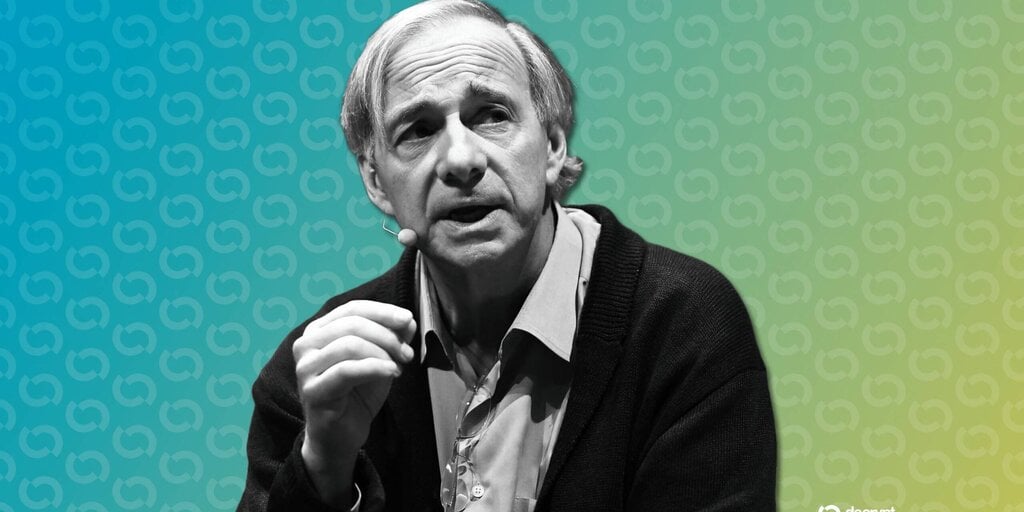

The U.S. economy is staring down a debt-fueled heart attack within the next few years, but that will likely buoy cryptocurrency prices, according to veteran asset manager Ray Dalio.

In an interview with the Financial Times, the Bridgewater Associates founder linked a rise in the price of digital assets and gold to America’s overwhelming debt burden, which isn’t improving, according to a transcript of the conversation that he posted to X on Wednesday.

The U.S. government is spending more money than it’s taking in, while servicing enormous amounts of debt. And as the government borrows more to cover budget shortfalls, while managing its existing burden, creditors could eventually cause trouble, Dalio said.

Creditors will sell U.S. debt as they grow worried about its ability to function as a store of value, he said. That will likely put the Federal Reserve in a tough position, Dalio added, where it has to decide between rising interest rates and a debt default crisis or printing money to buy debt and “try to hold real interest rates down, which will lower the value of money.”

The billionaire, who foresaw the 2008 financial meltdown, described it as the “traumatic last phase” of a “big debt cycle,” where over the course of history, excessive debt has culminated in an economic contraction and systematic crisis.

To that point, Dalio said that deregulation isn’t a threat to governments’ use of fiat currencies in stabilizing economies or facilitating international trade. It is rather unhealthy debt levels, he said, that are eroding the status of currencies like the greenback across several sovereigns.

“I do see the dollar and the other reserve currency governments’ bad debt situations as threatening to their appeals as reserve currencies and storeholds of wealth, which is what has been contributing to the rises in gold and cryptocurrency prices,” he said.

Bitcoin and gold have surged this year. The precious metal’s price has increased 38% year-to-date, hitting an all-time high of $3,530 per ounce Wednesday, according to Trading Economics. Bitcoin’s price has increased 20% to $112,000 over the same period, according to crypto data provider CoinGecko.

Dalio’s latest assessment of the U.S. economy follows the passage of the GENIUS Act, a federal framework for stablecoins. Dalio said that a decline in the purchasing power of U.S. Treasuries “shouldn’t produce any systematic risk” for them, if they are well regulated.

Dalio said cryptocurrencies resemble hard currencies, partly due to their so-called tokenomics. Bitcoin’s total supply, for example, is capped at 21 million, while the government can theoretically print an unlimited amount of money.

“Crypto is now an alternative currency that has its supply limited, so, all things being equal, if the supply of dollar money rises and/or the demand for it falls, that would likely make crypto an attractive alternative currency,” he said.

In late July, Dalio urged investors to allocate 15% of their portfolios to Bitcoin and gold. It’s a macroeconomic hedge amid increasing risks in bond and equity markets, he said.

Dalio expressed a preference for gold, arguing that a central bank is unlikely to adopt the leading cryptocurrency by market capitalization as a reserve currency. Still, the outlook for some fiat currencies is bleak, he said in the interview with the Financial Times.

“I think that most fiat currencies, especially those with large debts, will have problems being effective storeholds of wealth and will go down in value relative to hard currencies,” he said, pointing to parallels between the coming years and two periods in the 20th century.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.